As we kickoff our Fall Season here across Northwest Arkansas, our Real Estate prices are staying high and inventory is staying low, even as interest rates are rising and the number of closings has dropped from the peaks of previous years.

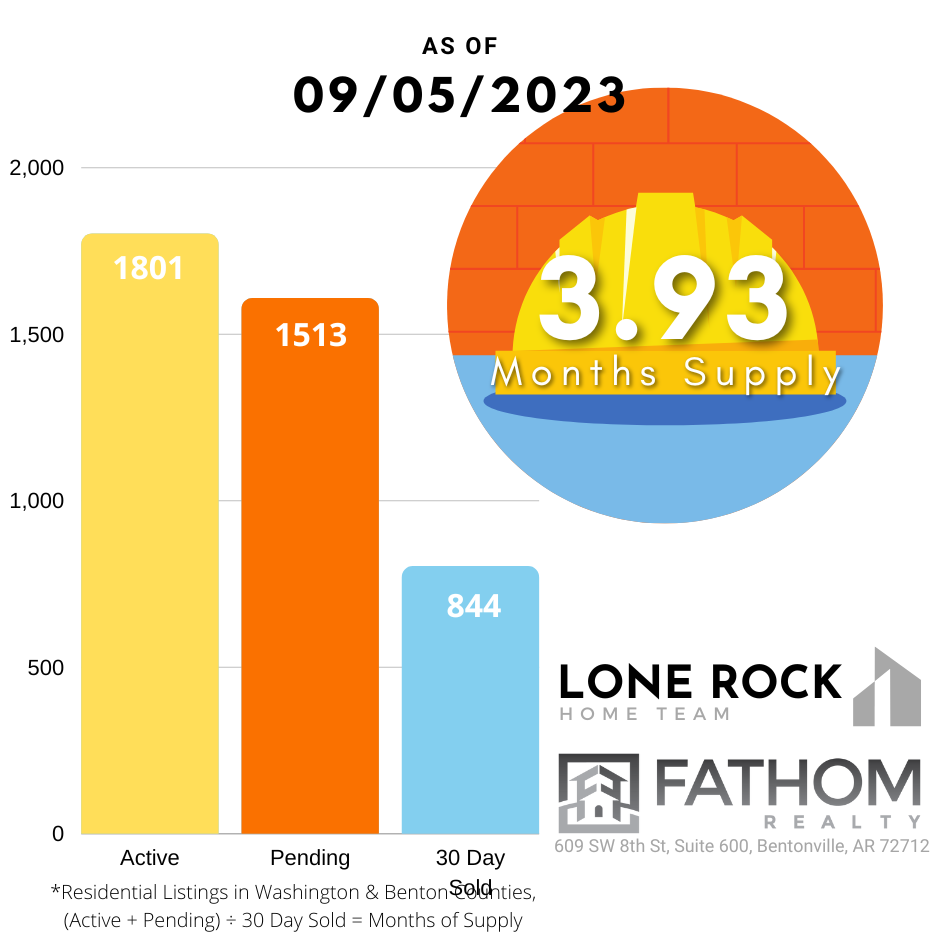

As you can see here, our Inventory is hovering around 4 months of supply, which means we are still in a Seller’s Market as Autumn begins to set in. Now, typically we see a more even market as we close out the Summer months, with more listings lingering on the market for longer, giving buyers a chance to lock in a nice home before the end of the year.

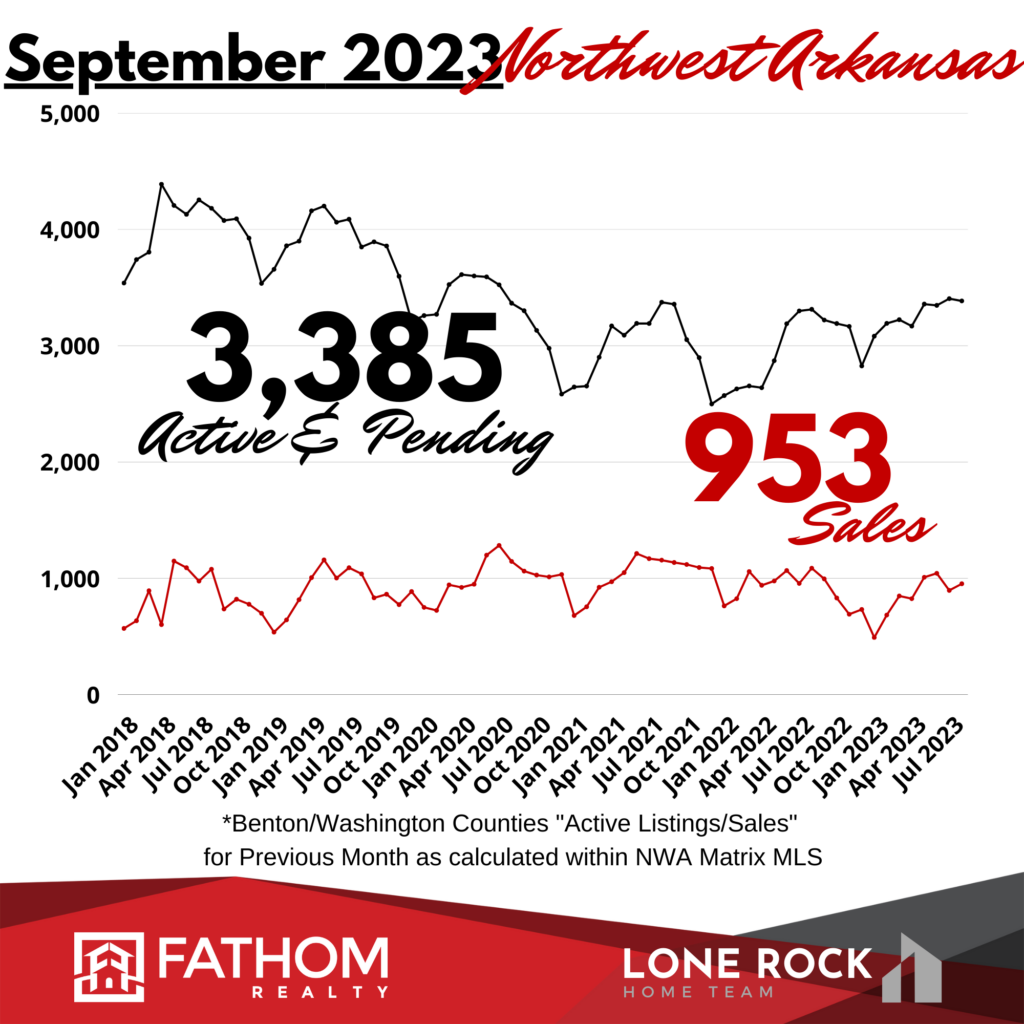

In this chart below, you can see the number of Active/Pending Homes in August just slightly lower than our level from July, similar to our peak numbers from last year at this time. Also, our number of Closed transactions came back close to 1,000 sales, up from last month’s numbers a bit to close out the summer season.

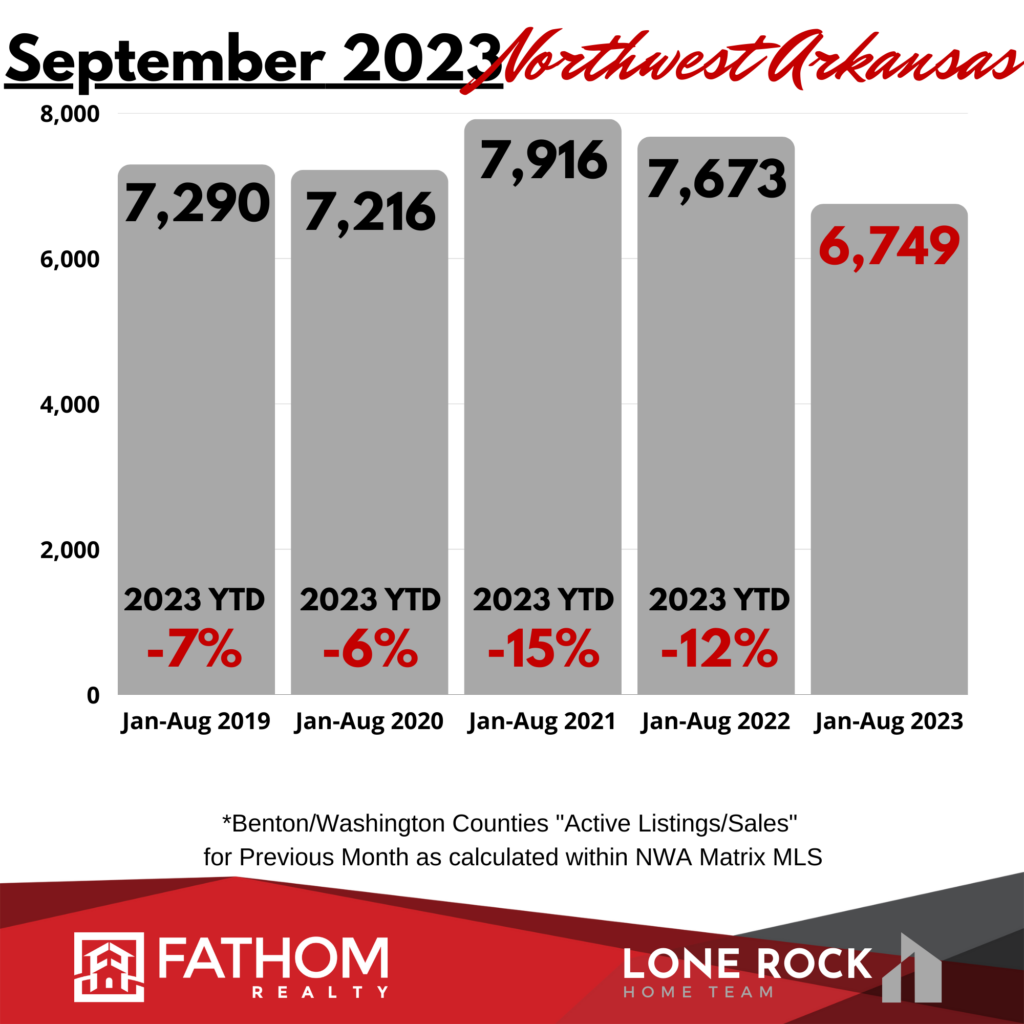

As for the number of transactions Closing, we have seen a drop in activity this year, compared to previous years. We’re closing 12% fewer homes Year-to-Date than the same period last year (2022.) When compared to the frenzy year of 2021, we’ve seen a 15% drop in sales activity. However, when compared to a normal market, like 2019, we only see a 7% drop in activity. So, the higher interest rates (which we’ll explore a bit later) are definitely having an effect on the number of people wanting to make a move within our market. But compared to the rest of the nation, our area is fairing very well. Compared to 2019 transaction numbers, many areas around the country are seeing drastic drops in activity with San Diego (-46%), Chicago (-54%) and New York (-52%) having some of the biggest drops in turnover.

But across NWA, builders are continuing to bring more inventory to our market, making up about 35% of our available inventory. Most homes are still finding a buyer fairly quickly, which is keeping our prices on the higher end, even continuing to break records this year.

Our May Average Home Sale Price had skyrocketed all the way up to $437,126! That was an all-time record for our area. Our June number ticked down just slightly to $429,204. Then our July number fell all the way back down to around that $400,000 baseline. And our August number bounced back up to $412,288.

Median price also held steady this month, from July’s $342,500, to August staying close at $341,990.

I expect this average pricing level to continue around $400,000, at least into the Fall. As we see a rebound in inventory, and as interest rates remain high, we will see a more balanced market this Fall and Winter. Prices should normalize and I don’t expect to see new highs for the rest of the year, although slight fluctuations up and down are normal for our market.

Average Prices Per Square Foot held around $200/SqFt this month.

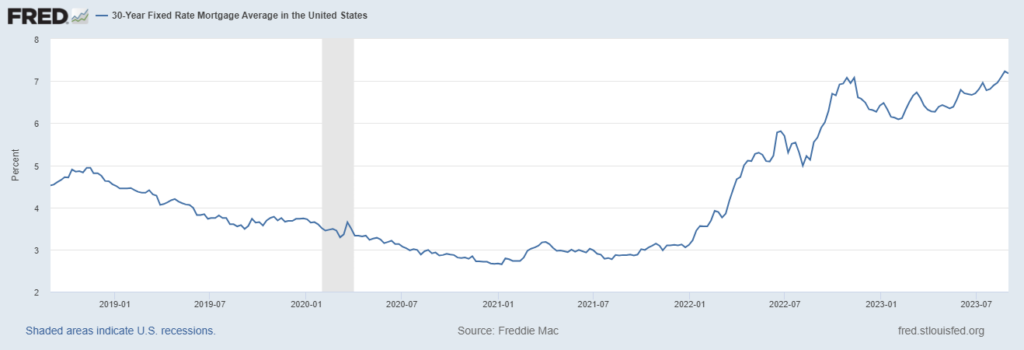

Mortgage Rates have hovered below their peak of around 7% for most of this year, dipping back down to almost 6%. Now they’re making new highs once again, currently at about 7.2%. This is keeping mortgage payments unaffordable for many potential buyers, creating a dampening effect on the true pent up demand for homes. That’s why we’re recommending buyers take advantage of the opportunities we will see this Fall in order to scoop up a good deal. We should see more inventory, longer days on market, and sellers willing to negotiate a bit more as the buyer pool shrinks.

What it all Means for You

Our Northwest Arkansas real estate market had a big Summer season, and we’re winding down into the Fall.

Right now, I’m seeing a big window of opportunity for buyers as more inventory should build into the slower months. If you’ve been thinking about making a move, now might be a good time. You can shop as we slide into a slower market, often with price reductions on larger properties. You’ll have less competition and if rates drop in the coming years, you’ll be able to refinance for increased savings at that time.

If mortgage interest rates fall in the future, I would expect another flood of buyers coming into the market and competing for the homes that are available. In that scenario, prices will jump even higher from current levels. So locking in a good price right now may be a smart bet. Then if you can refinance into a lower rate, you’ll have the best of both worlds.

Our lender partners can fill you in on all your options, including mortgage programs that may allow you to Buy Down your rate.

Also, we’ve put together a program to find “Hidden Inventory, Off Market Homes” for my clients without all the hassle and competition from other buyers.

This has been and will continue to be our #1 Strategy to get you and your family out of your current home and into your dream home. Let’s see what we can find together!

Just click here to learn all about the “Dream Home Finder” Program!

If you’ve been thinking you’ll wait till next year or later to make your move, I’d like to share a strategy to save you $20,000 to $30,000 and potentially hundreds of dollars off your monthly bills, depending on the equity position you have in your current home. Would that be a conversation worth having? If so, leave me a message below.

To see the strategies we’ve been implementing to sell for the most the market will bear, regardless of the time of year we’re in, Watch our “Pre-Listing Price Accelerator” Guide Here and see How To Maximize Your Home Sale. It will walk you through everything we’ve been doing at the LoneRock Team to get amazing results for our home sellers.