The market isn’t anywhere near a scary as October’s main holiday, as we still closed 1,053 Residential properties across Washington and Benton Counties in September 2020.

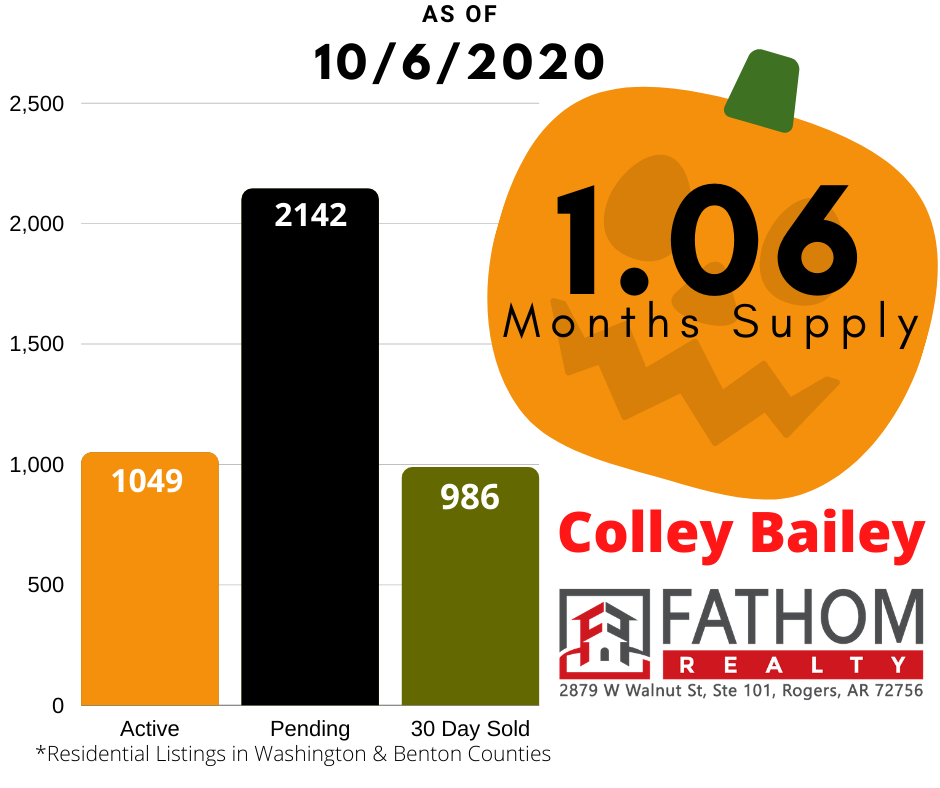

As of October 6th, we only had 1,049 in the market, so we still only have about 1 Month of Supply right now.

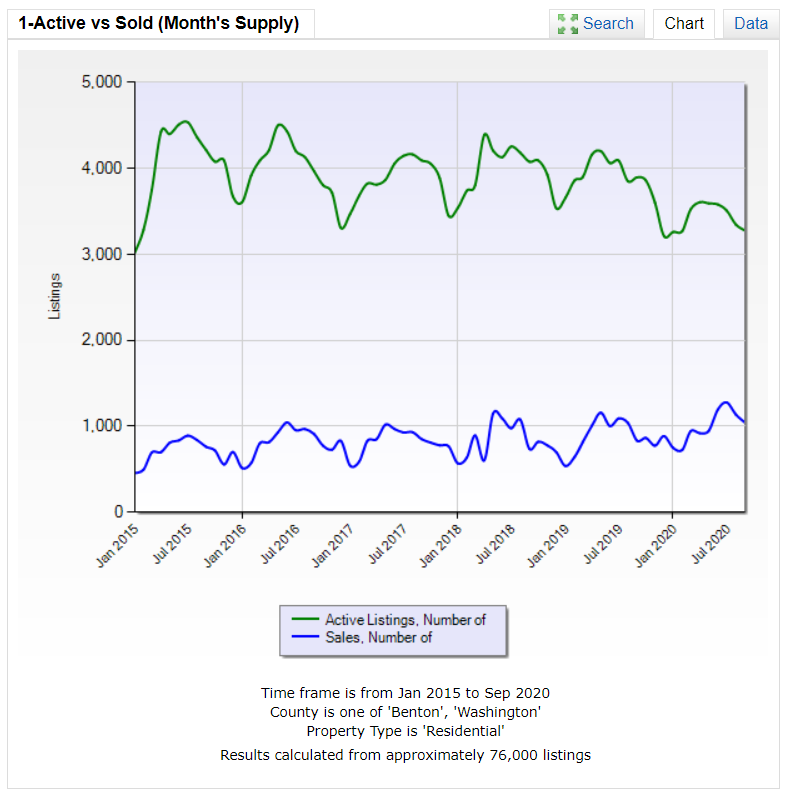

You can see the market getting tighter and narrower in the following chart comparing the monthly number of Active & Pending properties versus the number of Closed Sales. Comparing this year to previous years, we’ve generally sold more while at the same time, seeing fewer properties enter the market especially during the normal peak selling months.

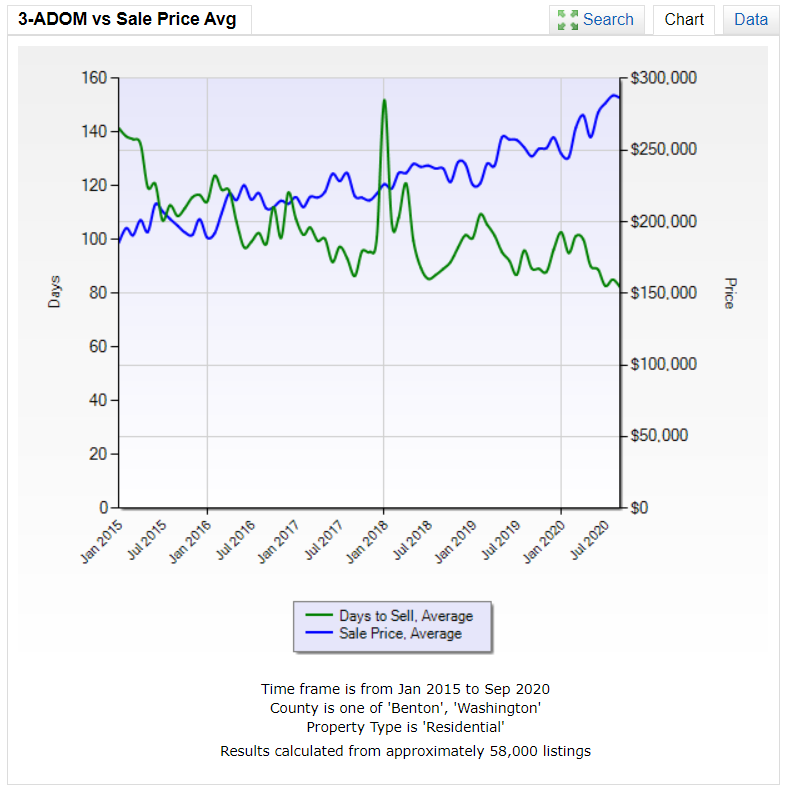

This month, we broke a September Pricing Record with an average sale price of $286,320, slightly down from $288,184 in August.

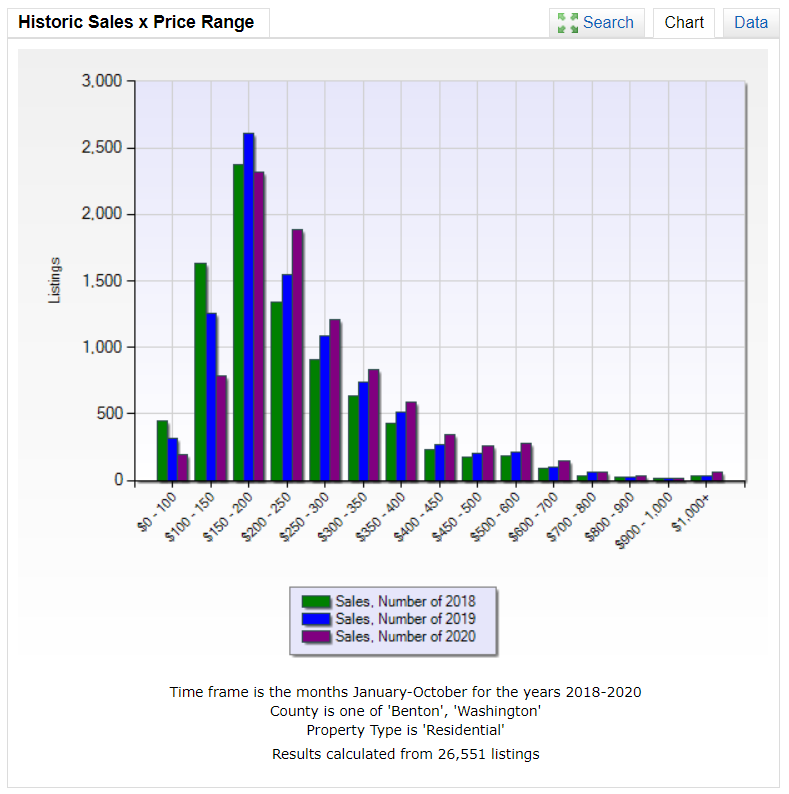

Also, the chart below shows the change in sale prices over the last 3 years across various price ranges. You can clearly see that our homes are being listed and sold at higher and higher prices this year.

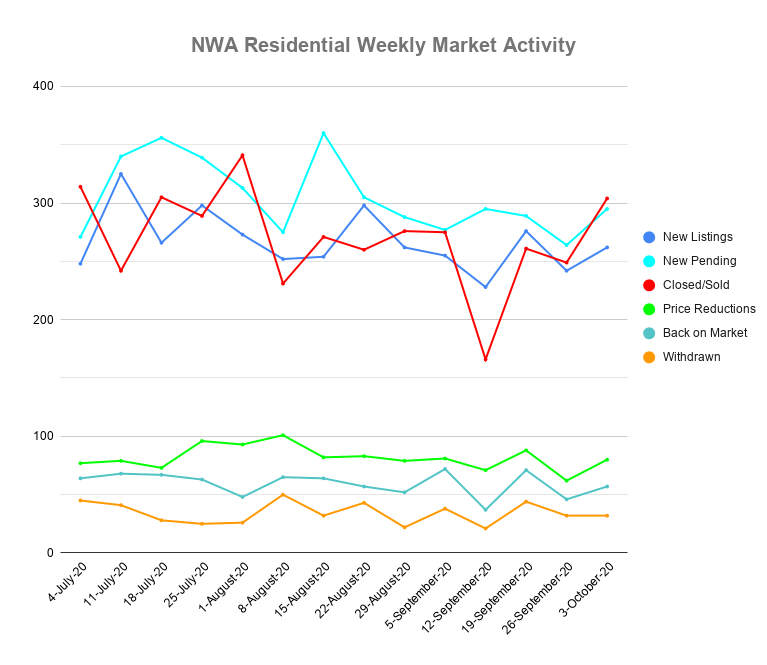

For 5 months now, New Pending sales have outpaced New Listings entering the market every week. This lower supply and higher demand is ensuring that multiple offers are being placed on most properties within a very short amount of time. For the last two weeks, there have been more Closings than New Listings, reducing our pool of properties even further. This scenario has happened several other times in the 3rd Quarter of 2020 as well.

Major Forces

The major market factors affecting real estate like Interest Rates, Employment Levels, and Governmental Interventions are creating a very unique situation for the markets both locally and across the nation.

Interest Rates

Interest Rates for mortgages are now hovering around their lowest levels ever, close to 3%, often below 3%. In fact, even compared to a year ago when 4% interest rates would fetch borrowers a principal & interest payment of $477 for every $100,000 they borrowed, today’s rates will allow the same borrower to qualify for $113,000 for the same $477 in monthly payment. This is one of the main drivers of the price increases we’ve seen this year, with many homes gaining $20,000 to $30,000 in value within a very short amount of time.

The lower interest rates have increased the buying power of average buyers, even though their income and debt ratios may have remained unchanged. However, this rate induced price bump can only go so far before it reaches an equilibrium with peoples’ debt-to-income ratios, and then home prices will stagnate. We may be close to that stagnation point now.

Since it is unlikely that mortgage rates will go much lower, any further price increases will only be the result of basic supply-and-demand market forces. This leads me to believe that the rate of price growth will slow as we move into 2021.

Jobs and Relocation

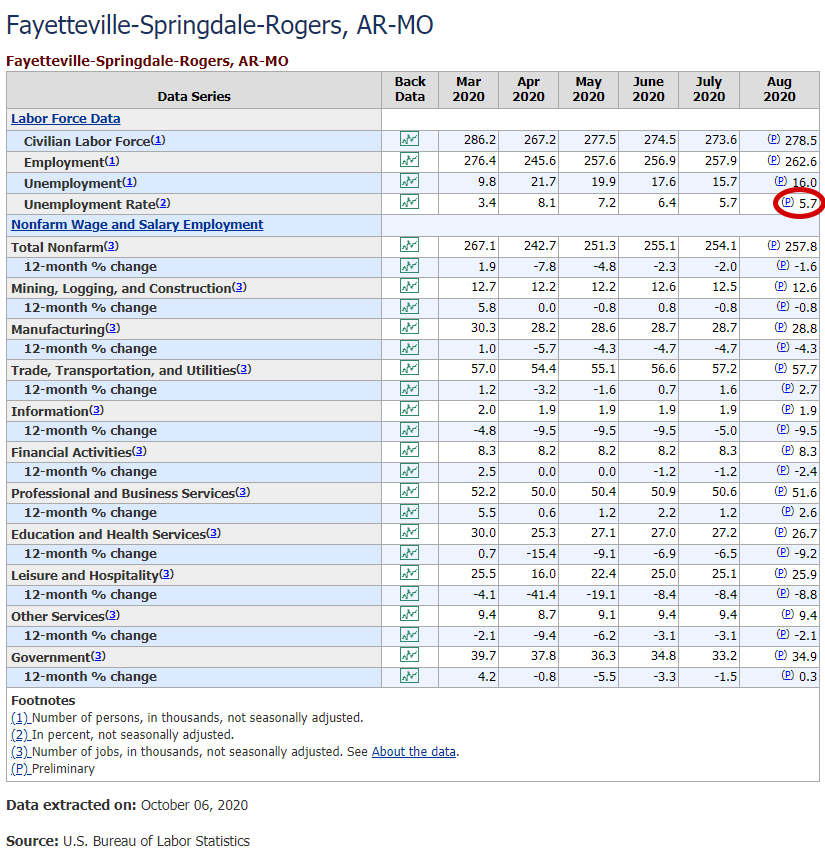

Jobs are a main driver of housing sales and affordability. The U.S. Bureau of Labor Statistics reported the national unemployment rate at 7.9% in September. However, here in NWA (in the chart below), we had bounced back to 5.7% by August 2020. That’s much less than the national average, so our area is holding fairly strong relative to the rest of the country as a whole.

Another reason for the housing market to have escaped much of the downfall of other sectors is that, by and large, most potential buyers have kept their jobs and incomes. The hospitality, restaurant, and front line retail workers were the hardest hit at the beginning of the pandemic, and many of these workers were in lower paid positions and were renting their dwellings. So, the buyer pool for Real Estate didn’t seem to change that much.

Governmental Response

As of now, Congress has failed to come to terms on any other agreement for addition stimulus or aid packages beyond the initial CARES Act. It isn’t clear what additional response, if anything, we should expect from the government at this time.

Evictions and Foreclosure

Part of the initial governmental response was protections on evictions and foreclosures. This was done to keep people in their homes and rentals as long as possible, and it has already strained our banking system and many landlords across the US.

With all the uncertainty in residential rentals, I have seen more and more landlords putting their properties up for sale. When these eviction moratoriums finally expire, and as yearly lease agreements end, I do expect many more properties to hit the market.

Likewise, Forebearances were put in place for homeowners who had trouble paying their mortgage, which had an initial period of 6 months and can be extended for another 6 months. The first deadline is hitting this month, and could lead to more homes being put on the market in an attempt to sell the house to avoid being foreclosed upon. The second and more definite deadline will be in the Spring of 2021.

Most of the affected homeowners will actually have good protections in place against foreclosure, such as repayment plans and possible deferment of missed payments. It’s possible that we could avoid large-scale foreclosures like we saw during the last financial/housing crisis in 2008/2009.

However, I do believe we will see an influx of homes being released into the market next year as landlords cash in on their portfolios and some struggling homeowners list their homes to avoid foreclosure. That increased inventory should flatten price growth and could potentially lead to lower prices if economic conditions don’t improve.

What it all Means for You

If you’ve been thinking of selling your home, PLEASE listen to me. We may be close to a price peak right now. We don’t know exactly how all this will play out. Hopefully, our record high prices can withstand the economic storm that has been brewing during this pandemic.

However, that may not be the case, and we may see prices fall as we head into 2021. You may not be able to sell your home at these kinds of prices if you miss this window of opportunity.

If we do see a price decline in Real Estate, there’s no telling how long it may take to recover. This decline won’t look exactly like the last Recession, but there are lessons to be learned from it. In that one, it took Real Estate 7 to 8 years to get back to the previous highs.

Are you prepared to stay in your current home for the next 7-10 years? Is it the best possible living situation for you and your family? If not, let’s chat. I want you to make it through in the best possible position.

I book Free Strategy Sessions for all my clients. No pressure or obligation, but I’d be happy to help you put a solid plan in place to guide you through these uncertain times.

Would it make sense to chat for a few minutes?

Just book a FREE Strategy Session with me Here to block out your own time on my calendar.

You could also Send me a message or give me a call today! (479) 777-3379