I hope you’ve been having a good fall season, hopefully getting out and enjoying these gorgeous red and golden leaves that are all across the Ozarks right now. I know we’re all looking forward to a good Thanksgiving as well. And in the real estate market we have a lot to be thankful for.

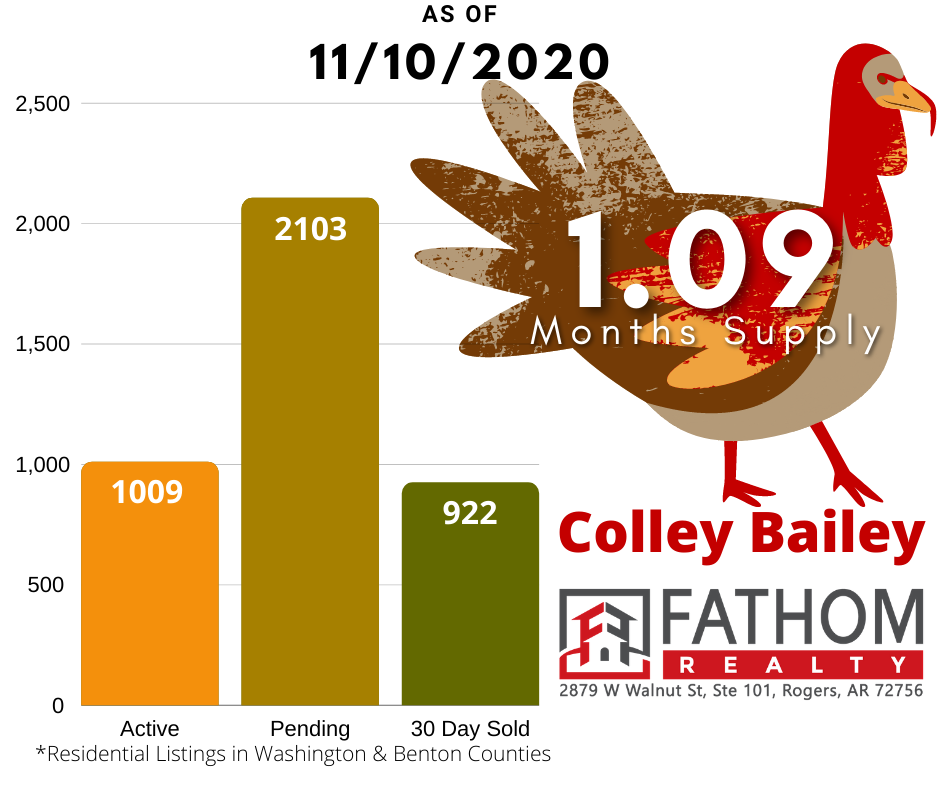

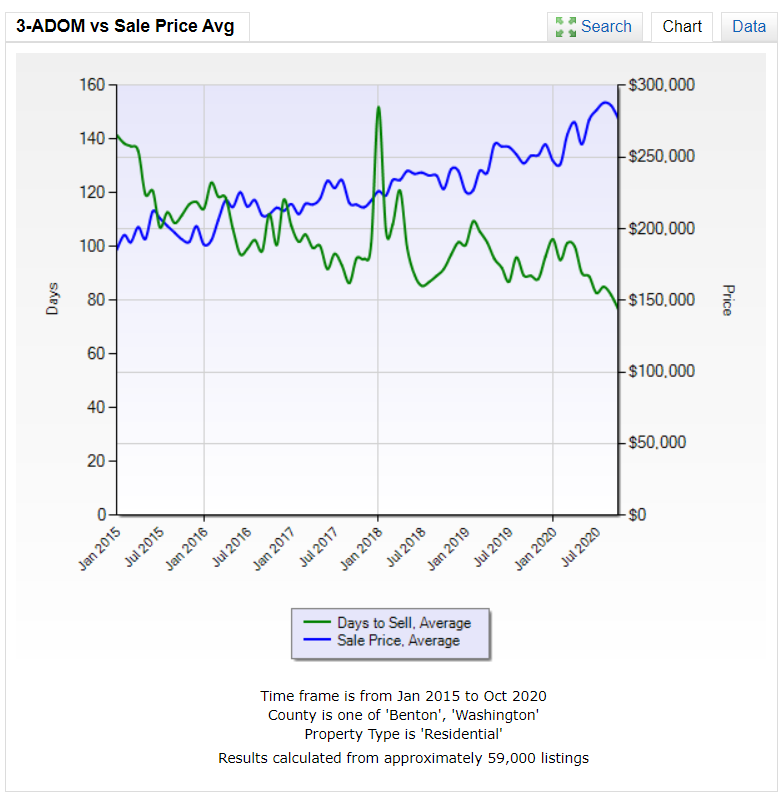

As of November 10th, we only had 1,009 houses in the market, so we still only have about 1 Month of Supply right now. That’s keeping our prices high as we go into the winter.

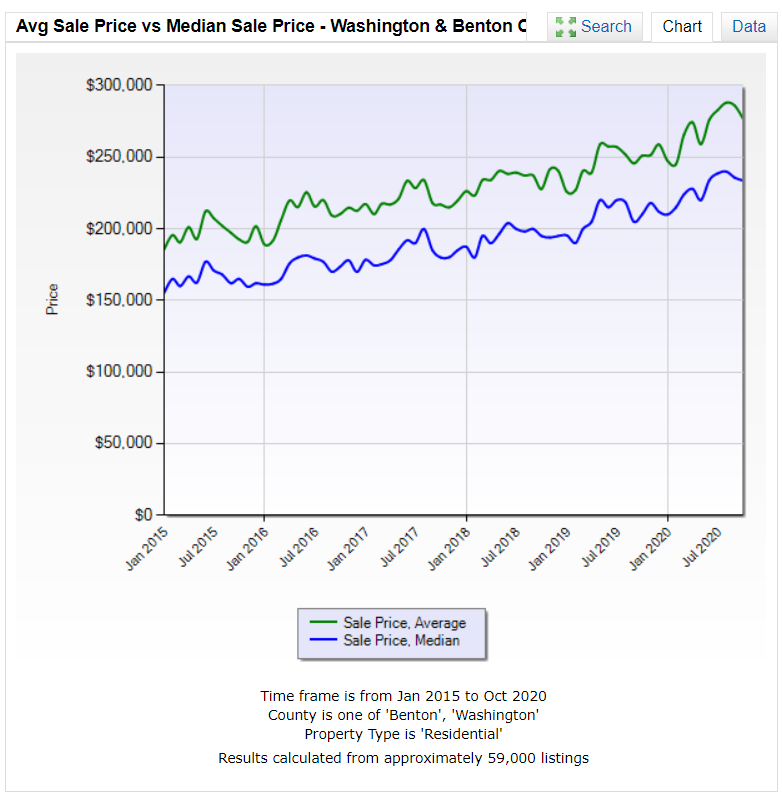

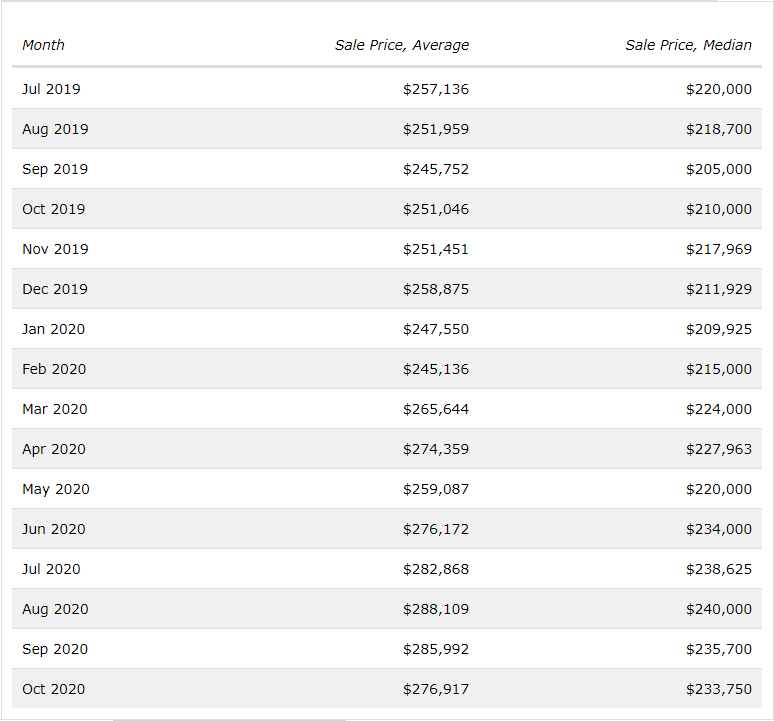

This month, although the average sale price slipped back a little to $276,917, it was still far above any month in 2019 which had peaked around $258,000.

Will there be a market crash?

At the moment, there are so many factors at play that it’s very difficult to make any kind of accurate prediction. Many people have predicted a foreclosure crisis during this pandemic similar to what happened in the 2008 financial crisis. I myself have even warned against this possibility in past monthly market updates. And I do think it’s always a good idea to prepare for the worst , even while hoping for the best.

However, as the months have worn on, I’m seeing different possibilities for how this might all play out.

Yes, CoreLogic analytics showed that mortgage delinquencies have reach a 20 year high, and the nation’s overall mortgage delinquency rate was 6.6% in August. However, much of this is due to the CARES Act provisions that allow mortgage borrowers to delay payments for up to a full year. It just makes sense that more people would take advantage of that than ever before.

The question is: What happens in the Spring of 2021 when these provisions run out?

How will the Foreclosure Crisis play out?

In order to answer that, we need to know how bad the numbers really are.

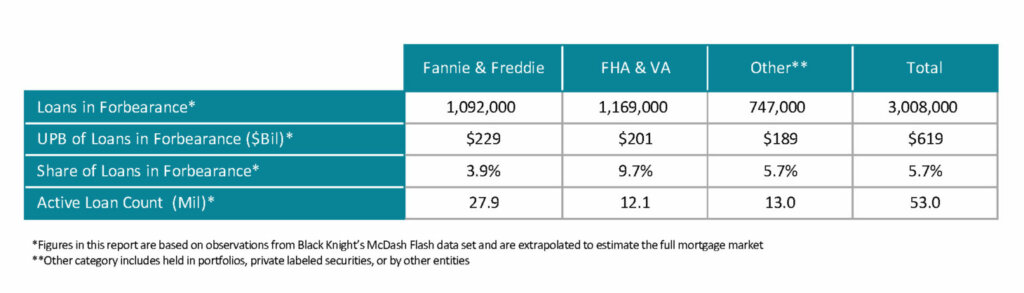

Research firm Black Knight said as of Oct. 27, approximately 5.7% of all active mortgages were in forbearance (meaning their lenders are letting them take a break from making payments without penalty). Considering that 38% of US homes are owned outright, that means only about 3.5% of total homes are in those forbearance programs.

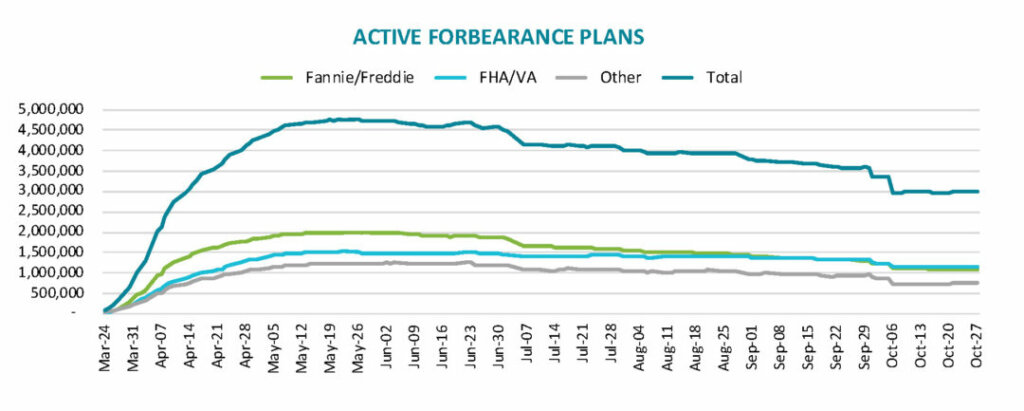

And the number of homes in these programs is about 1/3 lower now than in May and June. The number has fallen from over 4.5 Million homes, to around 3 Million homes. So, we’ve made great progress so far since the early Pandemic panic.

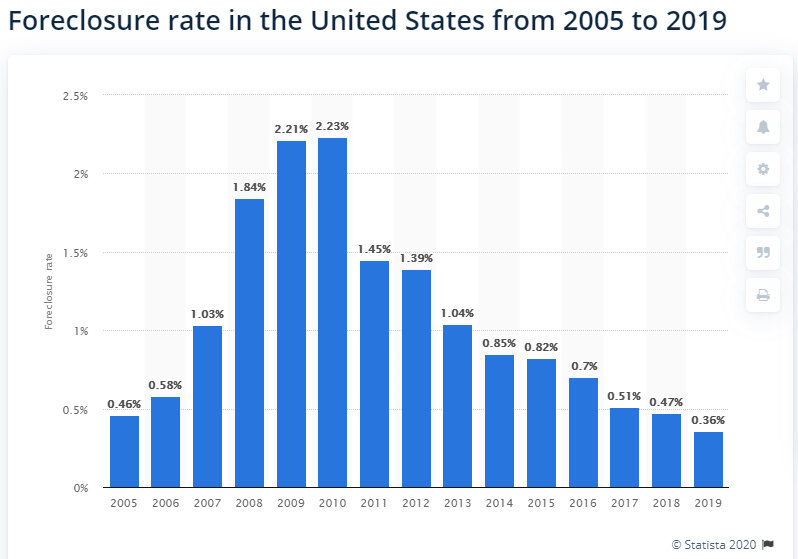

Now, if you compare this to the Foreclosures during the Great Recession, you might think we’re in even worse shape now. Back then, the foreclosure rate topped out in 2009-2010 at 2.21-2.23%. Compare that to the 3.5% in active forbearance and it looks like we could be headed for trouble in 2021.

But again the big question is: What happens in the Spring of 2021 when these Forbearance provisions run out?

Will the end of Forbearance (paused payments) automatically result in Foreclosure (Bank repossession)?

Well, probably not. Let me explain.

Lenders are much more willing to work with their borrowers now than they were in the last financial crisis. Nobody is looking for a repeat of ’08. Government officials and regulators are especially tuned in to providing solutions for borrowers during this time.

Solutions for Borrowers

There are many more options for borrowers coming out of the forbearance period. For federally backed mortgages, the lending institutions are required to work with their borrowers to help bring their accounts current.

As long as homeowners are able to start making payments at the end of their forbearance period, they will have several flexible repayment options:

- Pay back the balance owed and resume normal payments

- Add an additional repayment plan to catch up

- Restructure the debt with a loan modification to the interest rate and/or length of term to lower payments

- Defer the missed payments to the end of the loan, or until the property is sold

That last option is the most beneficial, as it essentially makes that 30 year mortgage a 31 year mortgage, and as long as the homeowner can start making their regular payments, they should make it through the transition just fine. No foreclosure necessary.

Another factor to consider is that about 70% of homeowners have more than 20% equity in their homes. That means they can easily sell the home without having to resort to a short sale or foreclosure. This is opposite of what happened during the ’08 crash when many homeowners were underwater.

As you can see, most of the affected homeowners will actually have good protections in place against foreclosure. It’s likely that we could avoid large-scale foreclosures like we saw during the last housing crash.

However, I do expect there will be some properties that still require a foreclosure in 2021.

Will Foreclosures affect Inventory Levels enough to make a difference in Prices?

In short, Probably not.

It’s helpful to remember that in 2008 there were many mortgages which had Adjustable Rates coming due, which meant mortgage payments became unaffordable for a lot of borrowers. This brought many to put their homes up for sale, and at the same time there was a boom in new construction homes being built. That created an over-supply of homes in the market. This lead to prices dropping, putting struggling homeowners further underwater and increasing the number of foreclosures and short sales over the following years. So it became a downward spiral for prices.

Coming into this crisis, and throughout this year, we’ve had a severe shortage of homes in the market. It’s the exact opposite of the last crash, and it’s what has caused prices to increase so dramatically this year.

So even if another 2-3% of homes hit the market in the Spring of 2021, our current buyer demand should gobble them up without a big decrease in pricing. In fact, we desperately need that inventory in order to keep first time homebuyers from being priced out of the market. (More on that later.)

Jobs vs. Unemployment

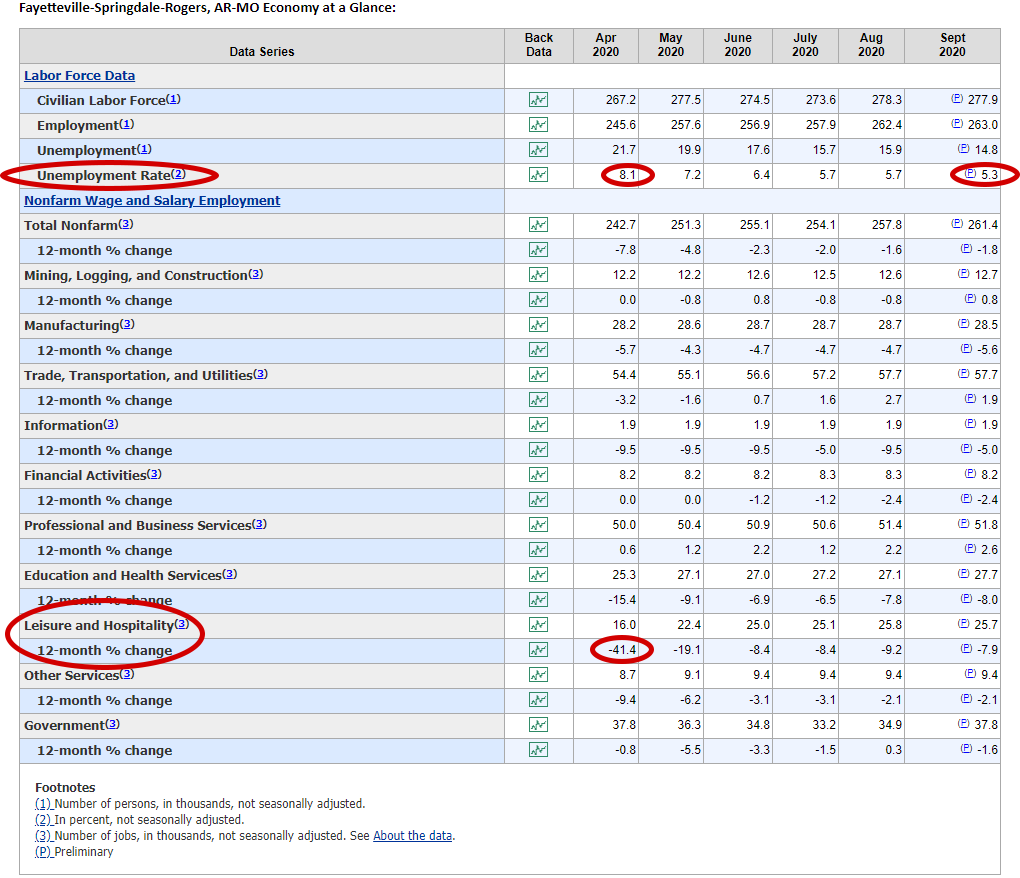

The biggest factor I’ve kept an eye on has been the employment data. When this all started, I said that if unemployment got too bad, our buyer pool could potentially shrink enough to cause home values to decline. But as a region and as a country, our unemployment data has seen improvements since April.

And as you can see, the sectors that were most affected are the leisure and hospitality sectors. The employees of these types of businesses already have low rates of homeownership and home buying due to lower wages. As a result, even high rates of unemployment in these sectors hasn’t affected our real estate market very much.

In general, our economy has bounced back really well, especially considering how bad it was in the early summer. Our area has gotten our unemployment rate back down to 5.3% as of September.

Now with Covid cases on the rise and a second wave spreading across the US, we will have to wait and see how well the economy can weather this storm. I sincerely hope we can avoid a second lockdown scenario. If that can be avoided, I’m fairly optimistic going into 2021.

Evictions

Since the beginning of the pandemic, an evection moratorium has been in place for renters. This has put quite a squeeze on some landlords across the country. I haven’t heard many local landlords talking about missed payments or difficulty with their rentals, though.

But with all the uncertainty in the system, I have seen more and more landlords putting their properties up for sale. When these eviction moratoriums finally expire, and as yearly lease agreements end, I do expect many more rental properties to hit the market.

So, we may see an influx of homes being released into the market next year as landlords cash in on their portfolios and some struggling homeowners list their homes to avoid foreclosure. That increased inventory could flatten price growth a little. It’s possible this could lead to lower prices if economic conditions erode again, but if we continue to see jobs growing and the economy coming back, our House prices would continue to climb.

Governmental Action

Of course, much of this will depend on the outcome of the presidential election as well. I don’t expect Trump to do another lockdown, but Biden might. The Democrats are also more likely to increase government spending to support the public, but the exact form of the aid is almost impossible to predict. Would they pass another round of stimulus? Would they extend Foreclosure and Eviction Moratoriums even past the current deadlines? Or would they try to enact a completely different program?

Only time will tell.

What it all Means for You

If you’ve been thinking of selling your home, right now is a historically good time to do so. Hopefully, our record high prices can withstand the economic storm that has been brewing during this pandemic.

However, that may not be the case, and we may see prices fall a bit as we head into 2021. We’re already starting to see the seasonal drop.

It’s unclear if we will see a second wave of the virus causing problems for our Spring selling season, along with some increased inventory due to the Foreclosure and Eviction issues. It’s possible that you may not be able to sell your home at these kinds of prices if you miss this window of opportunity.

Now, for Buyers, I see a lot of people hoping prices fall so they can get a better deal next year. Especially, in the starter home category, we’ve seen prices climb so high that many first time homebuyers have been priced out of the market. For their sake, I really hope we can get some more affordable homes into the market soon.

However, with interest rates staying low, and with job growth coming back, we may continue to see bidding wars and high buyer demand continue to push those prices higher. Waiting might not be the best solution for buyers either.

I book Free Strategy Sessions for all my clients. No pressure or obligation, but I’d be happy to help you put a solid plan in place to guide you through these uncertain times.

Would it make sense to chat for a few minutes?

Just book a FREE Strategy Session with me Here to block out your own time on my calendar.

You could also Send me a message or give me a call today! (479) 777-3379