As we move into the Summer months here in Northwest Arkansas, the Real Estate market is heating up as well. Make sure to stick with me to the end of this article for all the market details here in your May 2024 Monthly Market Update.

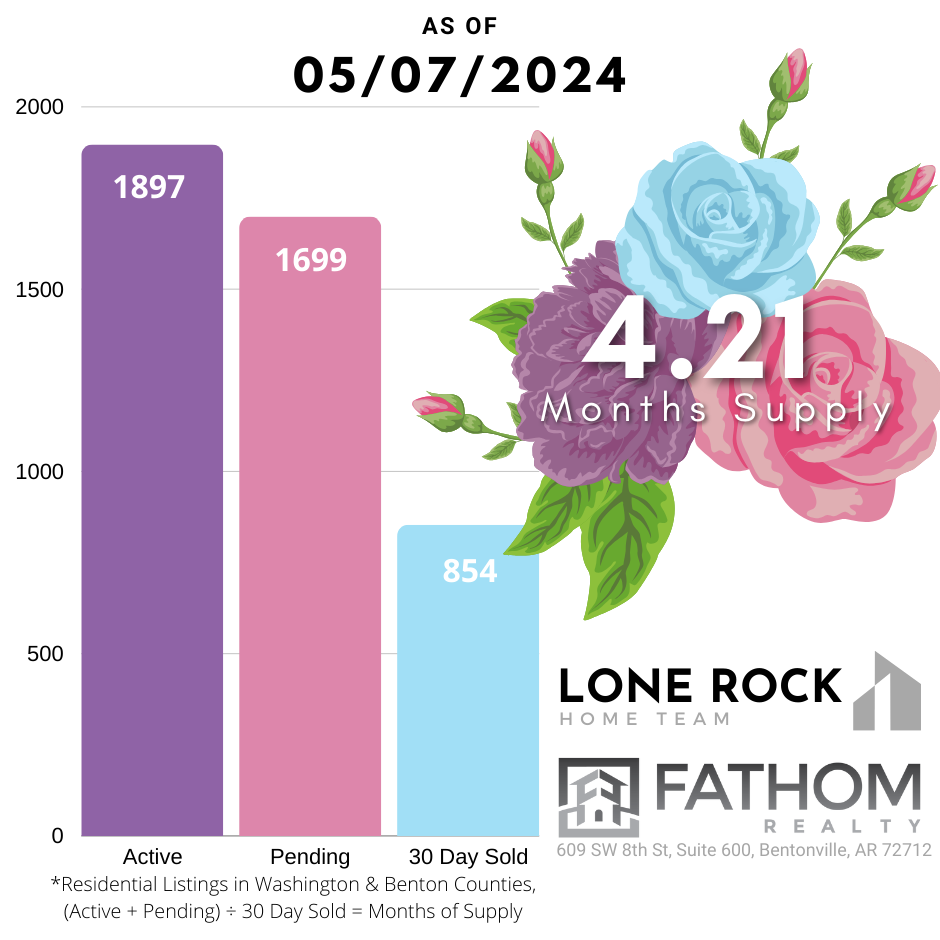

As usual, let’s start with our inventory levels, we are now down to 4.21 Months of Inventory. That means we are basically back in a Seller’s Market. For reference, that statistic tells us that if no other homes came into the market, and given our current pace of homes selling, we would be completely out of homes in about 4 months. That’s considered to be a pretty low supply, and I’d expect that number to continue going lower into our Summer season.

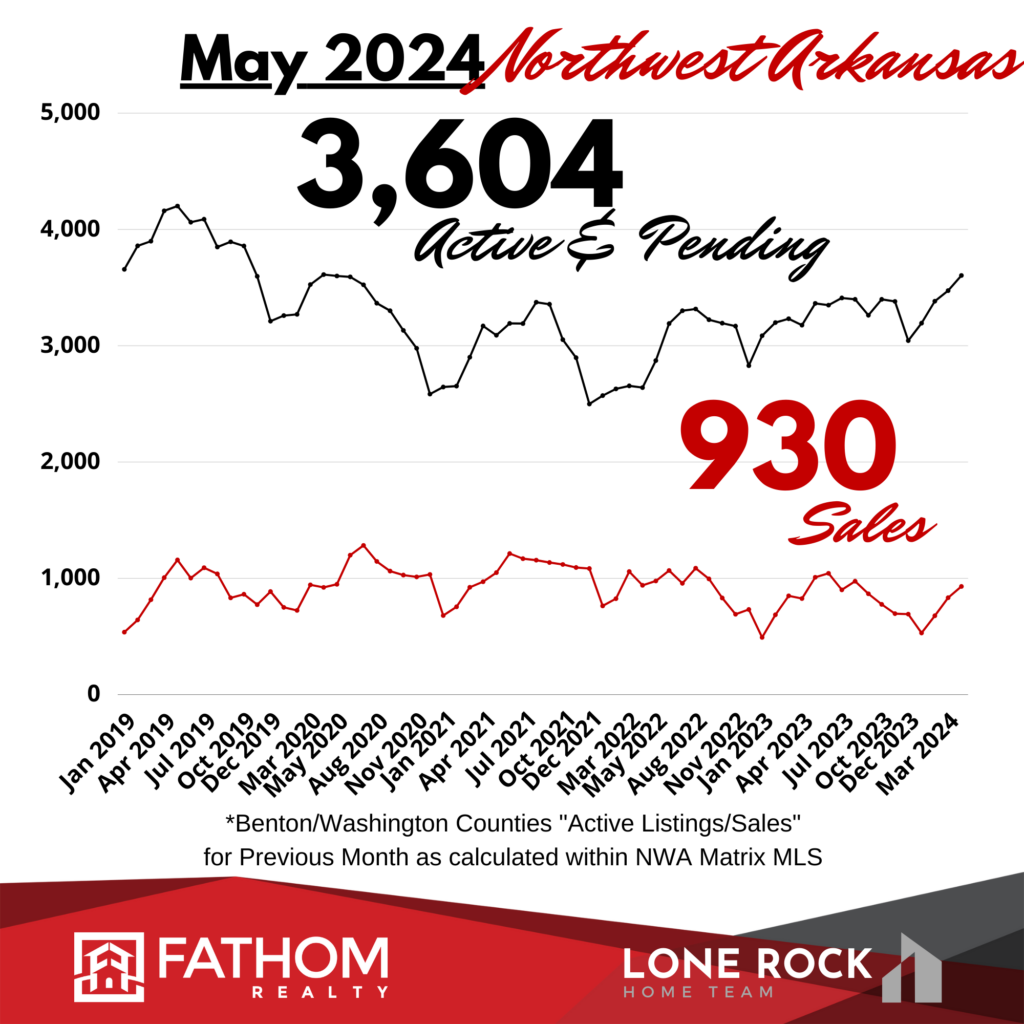

With 930 Sales recorded in April, and 3,604 Active and Pending listings, we have more sales and more inventory than this time last year (826 & 3,177 respectively). We’re seeing more supply in our market now than at any time since 2020. In fact, we’re matching April 2020 almost exactly, as we had 922 Sales and 3,612 Active & Pending homes at that time.

We’re still well below Pre-Covid inventory levels like we saw between 2016 through 2019. But it looks like we’re moving back into a more stable market like what we had back then. There should continue to be a few more homes in the market than what we’ve been seeing the last few years, so you home Buyers should have more options, and we may see our sales numbers increasing this summer.

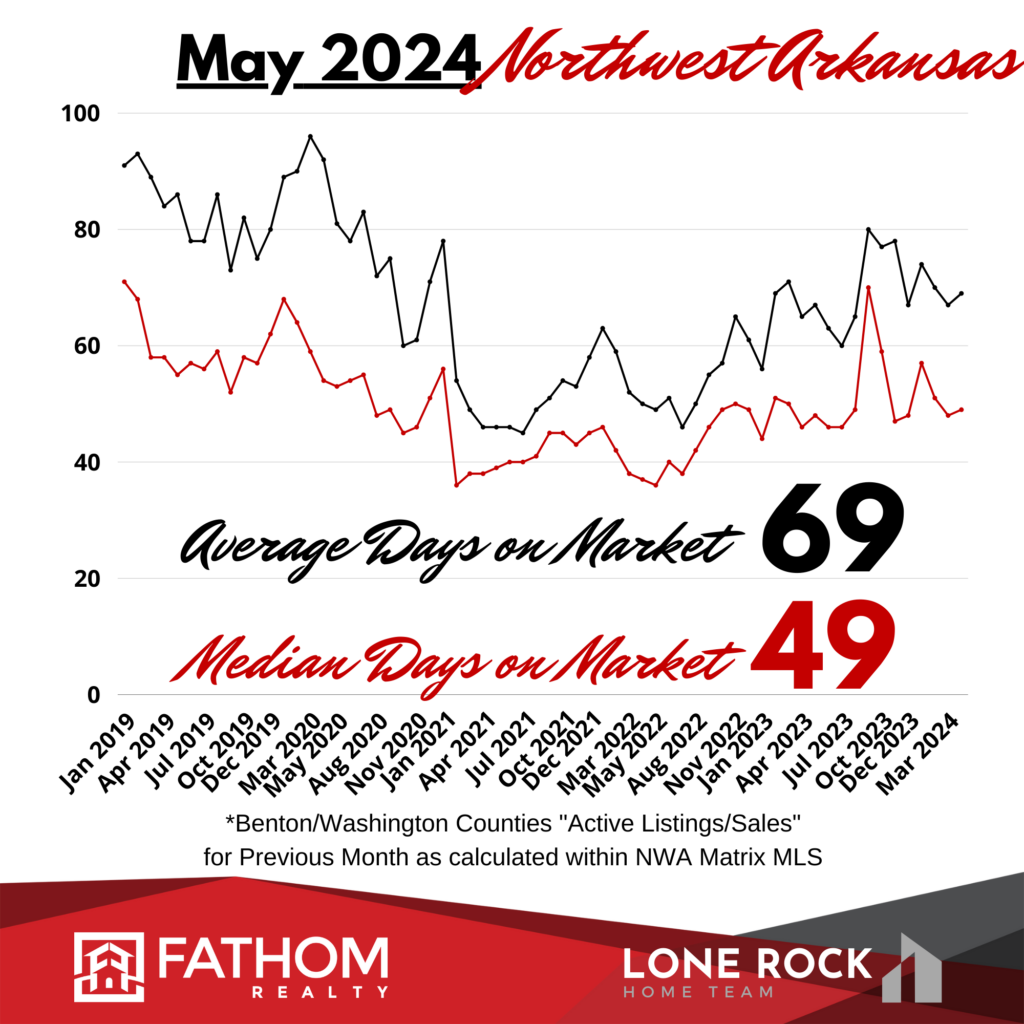

In April, the average days-on-market for Resale Homes stayed steady at 69 days, and the median days-on-market came in at 49 days. So, even with more properties on the market, the pace of sales has also increased, and so our Days on Market has been staying lower. Most property listings are getting buyers locked in within the first few weeks of listing. But, again it’s definitely a slower pace than the frenzy we saw during the Summers of 2021 and even 2022.

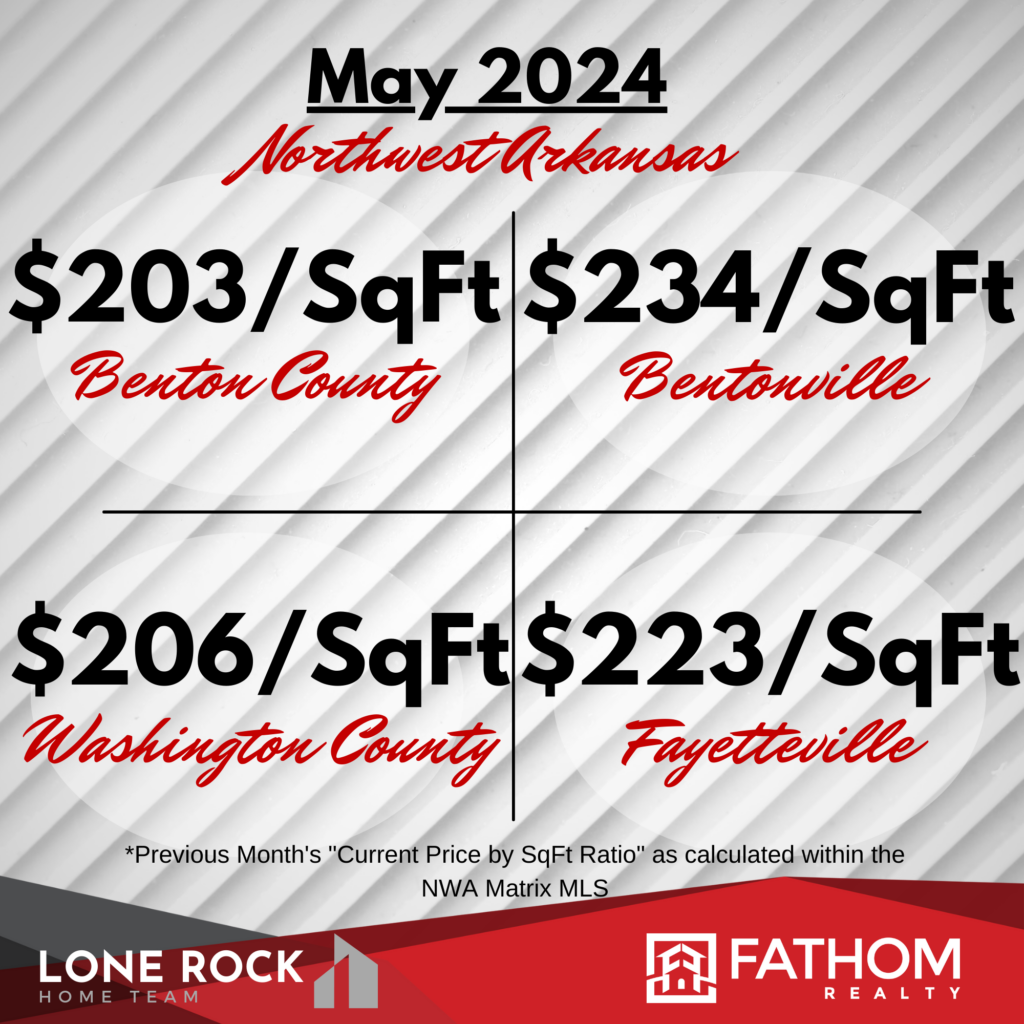

Average Prices Per Square Foot around the region stayed right around $200/SqFt this month.

As for pricing, April’s Average Sale Price of $406,321 stayed right in line with expectations, maintaining our trend of levels around $400,000. I’ve been expecting this to move higher as we get into the Summer months, but if rates stay high and if wages don’t rise, we could even see prices stall out around this level and potentially even retract from here.

As you can see, our pricing has basically been trending sideways for the last year, with this April number sticking close to last April’s Average of $401,410.

Our April Median Sale Price of $350,000 continues the pricing level we’ve maintained for the last 10 months.

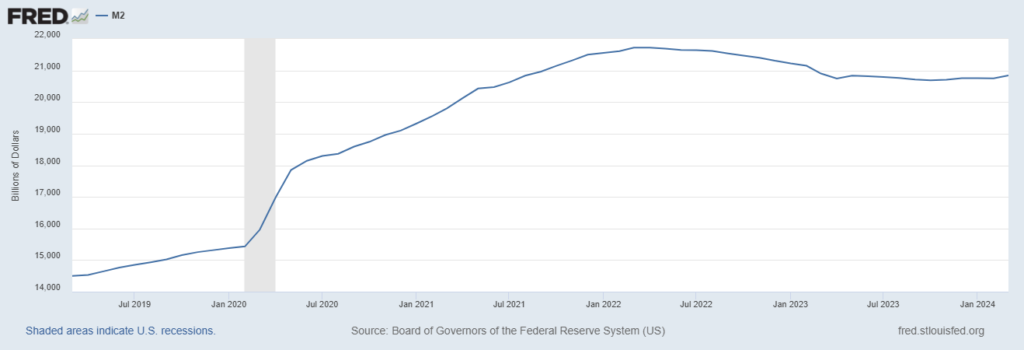

I’ve often made the case that Real Estate is one of the best ways for the average person to hedge against inflation. And that’s because the price of Real Estate is heavily tied to the money supply. As more more is printed, this is monetary inflation, and as there is more money introduced into the economic system, it tends to drive the prices of all hard assets (like land, gold, commodities, etc.) higher.

I’ve included the M2 Money Supply from the Federal Reserve right below our local pricing graph, and you can see that as more money was dumped into the economy in 2020 and 2021, there was a direct corresponding rise in our Home prices. (This happened all over the US for the same reason)

Our money supply went from around $14 Trillion to over $21 Trillion, and the NWA home prices went from a Median of around $200,000 to over $300,000.

Now, of course I typically just track the local supply and demand metrics for our Northwest Arkansas market, but these broader economic forces are always at play. You can also clearly see that when the Fed started raising interest rates and starting its Quantitative Tightening policies in 2022, the M2 (the amount of currency in the economy) leveled off and flattened out. Around that same time, home prices in our local market began to so the same.

This tells me that home prices will likely remain around this level for the foreseeable future, especially as the Federal Reserve is now set on maintaining a “Higher for Longer” policy on interest rates.

As for financing, the 30-year fixed-rate mortgage average is now around 7.09%. This is lower than our peak rate of 7.8% back in October 2023. However, this is still a fairly restrictive rate for a lot of buyers. Nevertheless, this is the rate environment we will probably be in for a while.

I’m hoping we can get rates back into the Sixes later in the year, but only time will tell.

What it all Means for You

Despite rates where they are, there has been a lot of pent up demand for homes. There have been a lot of people sitting on the sidelines, and quite a few are finally deciding to jump in. With prices staying relatively flat and stable, now might be the perfect time if you’ve been thinking about making a transition.

We’ve even been helping some clients lower their overall bills by making a move, even if their mortgage payment rises, because they can use all the equity they’ve gained in their house to pay off even higher interest rate debts like auto loans, personal loans, or credit cards.

Of course, whether you’re in the market for your dream home or considering selling your property, or both, all of us here at the LoneRock Team at Fathom Realty would love to assist you every step of the way.

Also, we’ve put together a program to find “Hidden Inventory, Off Market Homes” for my clients without all the hassle and competition from other buyers.

This has been and will continue to be our #1 Strategy to get you and your family out of your current home and into your dream home. Let’s see what we can find together!

Just click here to learn all about the “Perfect Home Finder” Program!

To see the strategies we’ve been implementing to sell for the most the market will bear, regardless of the time of year we’re in, Watch our “Pre-Listing Price Accelerator” Guide Here and see How To Maximize Your Home Sale. It will walk you through everything we’ve been doing at the LoneRock Team to get amazing results for our home sellers.

It’s shaping up to be an exciting Summer selling season this year. So, thanks for checking out this Monthly Market Update. We’ll catch you on the next one!