As we move forward into Spring 2023 in Northwest Arkansas, the Real Estate market is showing signs of revival. The Federal Reserve’s interest rate hikes last year caused a ripple effect in the market, resulting in higher mortgage payments, and causing potential home buyers to pause their buying decisions. Consequently, in January we experienced one of the lowest numbers of transactions in several years.

In contrast, we witnessed a sudden surge of buyers returning to the market in January and February. After coming to terms with the high mortgage payments necessary to purchase a home, many buyers took advantage of the slight dip in mortgage rates and began putting offers on homes. We’ve even started seeing the resurgence of multiple offers on desirable properties.

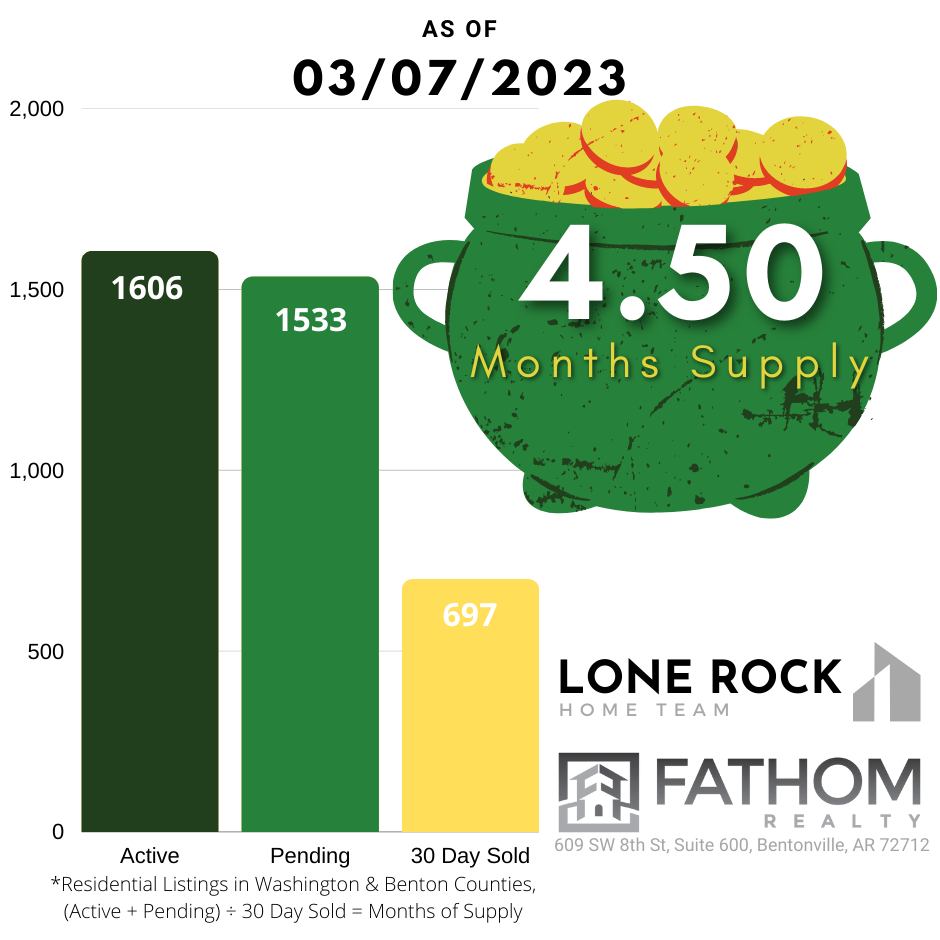

In fact, as I predicted, the number of homes closing in February increased from the January low. This changed our Months of Supply equation from 6.45 Months of inventory all the way down to 4.50 Months. This swings the market from a balanced market back towards being a Seller’s Market coming into the Spring Selling Season.

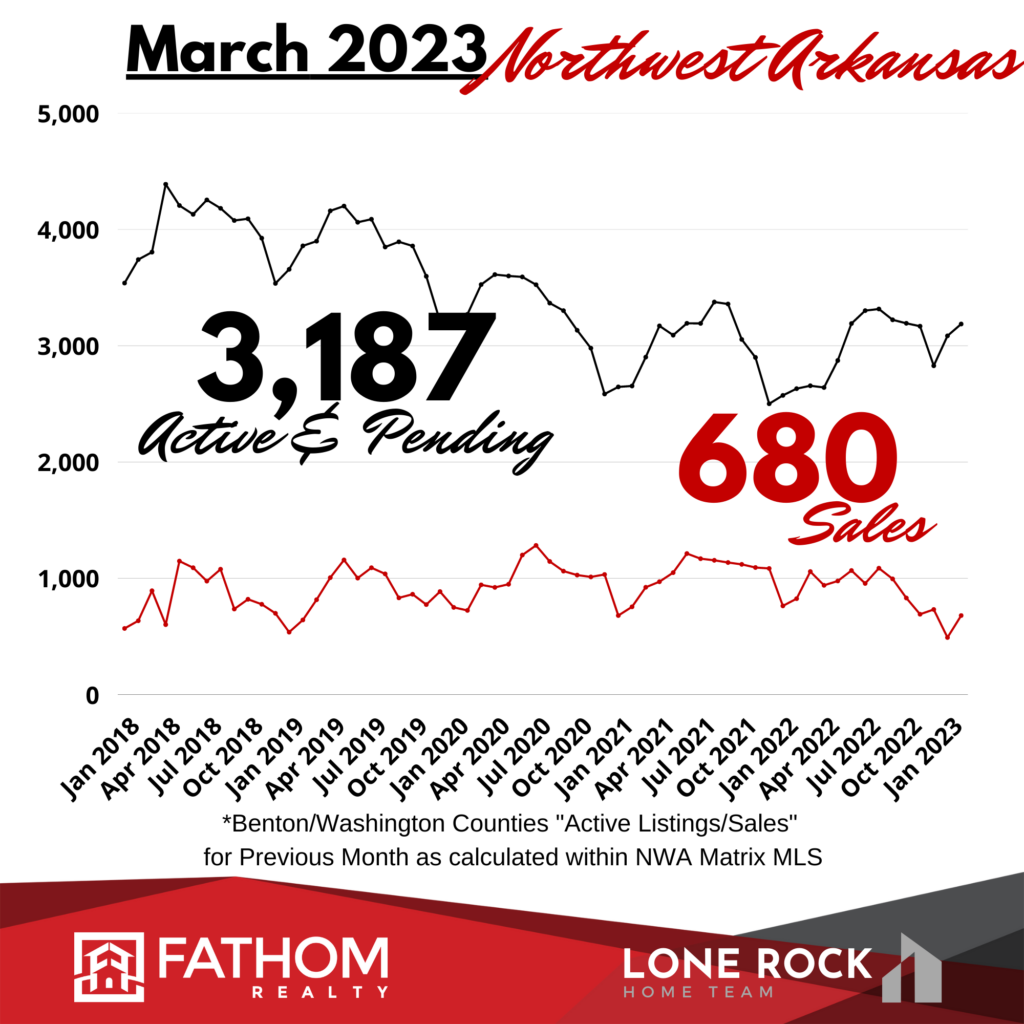

As more homes are listed over the coming months, I’m expecting our transaction numbers to increase as well. In the chart below you can see the number of Active and Pending Homes bouncing off the December low and starting to climb.

The number of Closings seems to be following that trend and increasing as more inventory is hitting the market, albeit always about a month behind. This indicates most homes are finding a buyer fairly quickly, keeping Days on Market low.

Despite the surge in buyers, pricing is still trending sideways for now, akin to the flat trend seen in 2018, which was also a year of rising interest rates. If interest rates rise from this level, prices will likely experience downward pressure, whereas falling rates will result in higher prices.

In February, the average sale price was $387,692, which is still 8.15% higher than February 2022. The Median price went up to $332,000.

Although prices have stabilized in this range, the market appears to be building a support level here and it’s primed to break higher as we move into the Spring and Summer. The high buyer demand early in the year leads me to believe that we will be heading back into a moderate Seller’s Market, with prices rising throughout the next several months.

Demand for homes in the region is strong, with slightly higher inventory levels than the past few years. The buyer pool is smaller than it was this time last year, as interest rates have significantly impacted affordability. However, there are many buyers who simply can’t wait any longer and are jumping on the opportunity to buy a home now, with less competition.

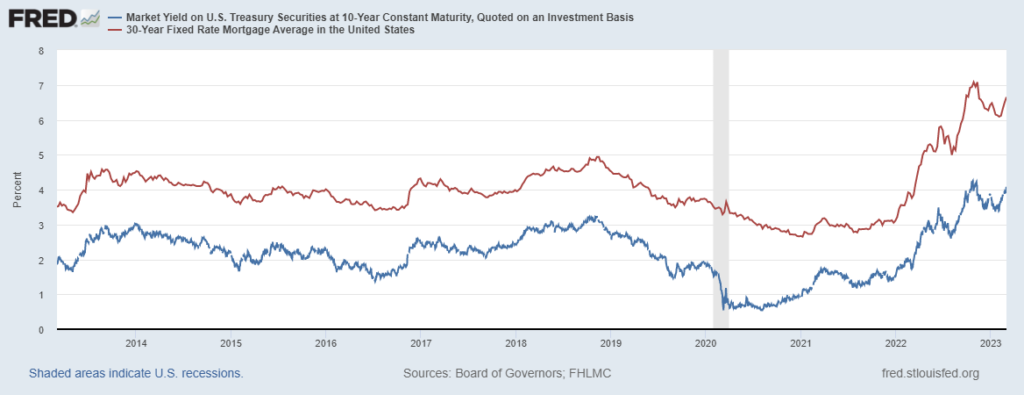

Also, mortgage rates are holding to a higher range above the 10 Year treasury than their historical trend. Mortgage rates are currently slightly more than 2.5% over the 10Y, but they’re usually under 2% above it. This indicates we could see a compression of that range back to a more normal range. If that happened, it would lower mortgage rates back to about 6% and increase affordability for many buyers.

We are experiencing a balanced market, and as the rate shock subsides, more buyers are expected to join the market in the Spring. Moreover, with mortgage applications on the rise and several multiple offer situations already observed in January & February, our March closing numbers are expected to continue climbing higher.

Overall, we are anticipating a strong Spring market with fairly robust sales numbers and slightly rising prices.

What it all Means for You

Will the Federal Reserve finally get a handle on inflation? Will interest rates be allowed to fall? Only time will tell, but for now, our northwest Arkansas real estate market seems to be holding up very well. It’s a very resilient market.

Right now, I’m seeing a big window of opportunity, especially for sellers since we’ve had prices stabilize at this higher level. If you’ve been thinking about selling, now might be a good time to consider putting real plans in place to cash out on that equity.

To see the strategies we’ve been implementing to sell for the most the market will bear, Watch my “Pre-Listing Price Accelerator” Guide Here and see How To Maximize Your Home Sale. It will walk you through everything I’ve been doing to get amazing results for my home sellers.

For buyers, even at higher interest rates, the opportunity is in getting a home with less competition from other buyers in this low inventory market. Many analysts think mortgage interest rates will fall throughout 2023. And if that happens there will once again be a flood of buyers coming into the market and competing for the few homes that are available. In that scenario, prices will go even higher. So locking in a good price right now may be a smart bet. And if interest rates happen to go lower in the future. A refinance is always a possibility.

In the meantime, mortgage programs like a 2-1 Buy Down may be helpful for keeping payments low in the short term. In that program, your interest rate is two points lower in the first year and one point lower in the second year before finally settling at the base interest rate in the third year. You may also be able to buy down the rate permanently. Our lender partners can fill you in on all the details if this would be a good option for you.

Also, I’ve put together a program to find “Hidden Inventory, Off Market Homes” for my clients.

This is my #1 Strategy to get you and your family out of your current home and into your dream home. Let’s see what we can find together!

Just click here to learn all about the “Dream Home Finder” Program!