Welcome to 2024, everyone! As the fireworks and champagne of the New Year celebrations fade away, many people are left wondering what’s coming in 2024, especially with the broader economy facing headwinds and slowing down. There’s a lot of talk about an impending recession on the news, and yes, it’s an election year, so I feel like 2024 is going to be a year of change. And of course, how does that affect the Northwest Arkansas economy and our local housing market?

That’s what we’re covering in this January 2024 Monthly Market Update

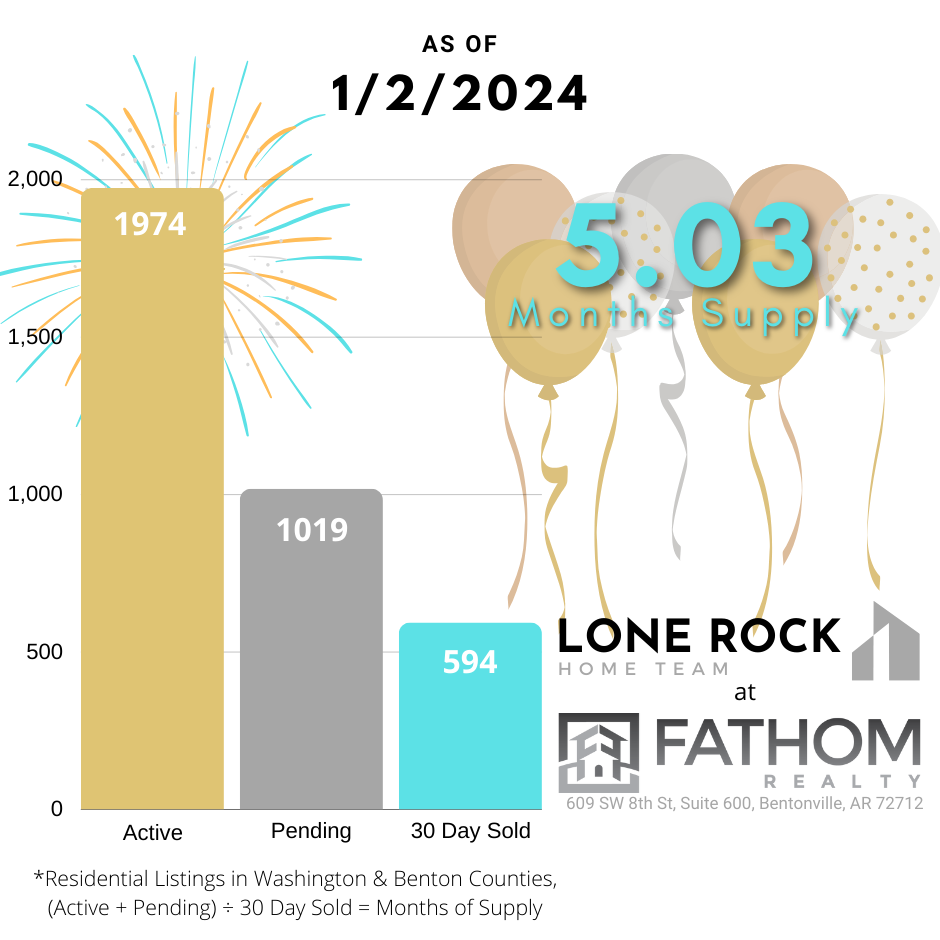

As you can see here, our Inventory is now around 5 months of supply, which is a slight Seller’s Market verging on being more neutral than what we’ve seen most of last year.

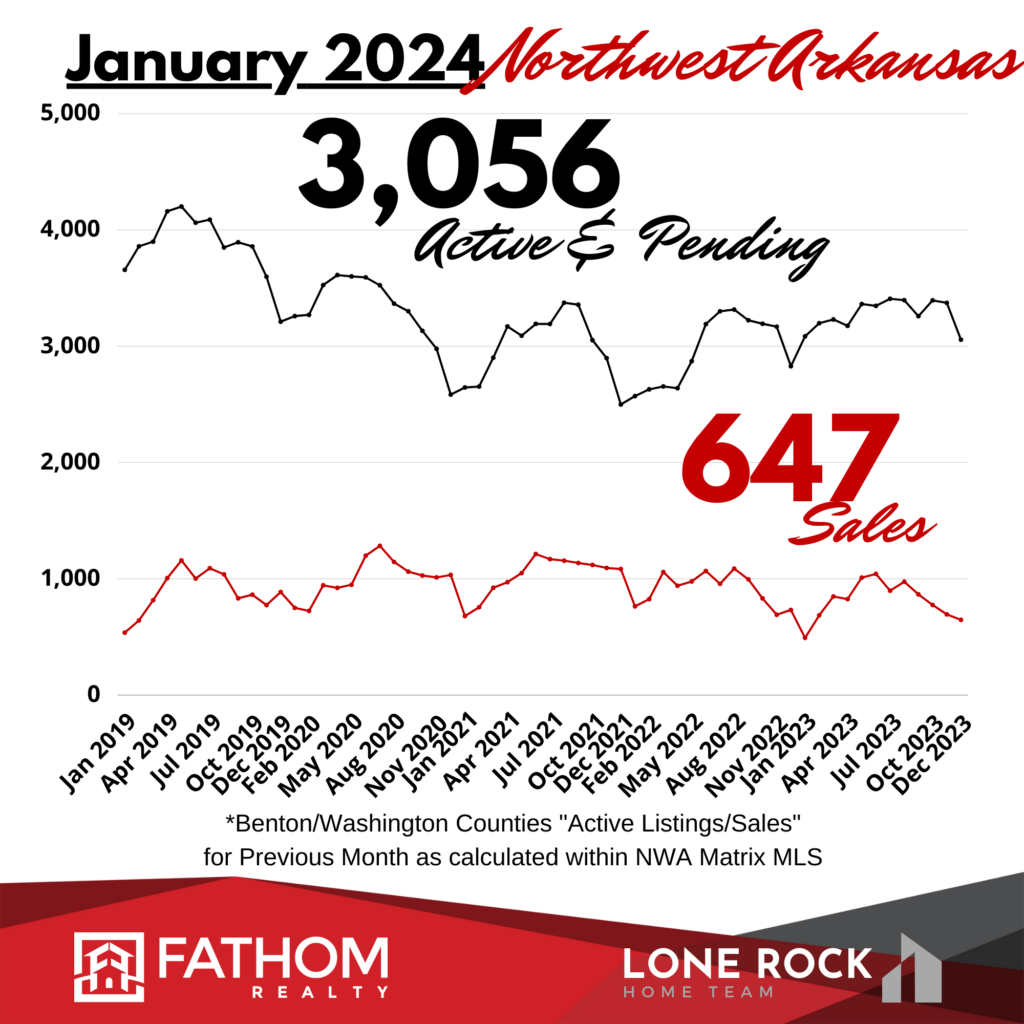

In this next chart, you can see the number of Active/Pending Homes dropping off toward the end of the year, down to only 3,056 homes in the market during the month of December. This is the normal year-end drop in supply that we see almost every year. However, this is more than the seasonal dips we’ve seen for the last three years, so we’re starting to hold more properties available in our market. Our number of Closed transactions went down to 647 sales in December, which is very similar to the last several years of December Closings. So overall, inventory is slightly up and closings are going a little lower, which is to be expected this time of year.

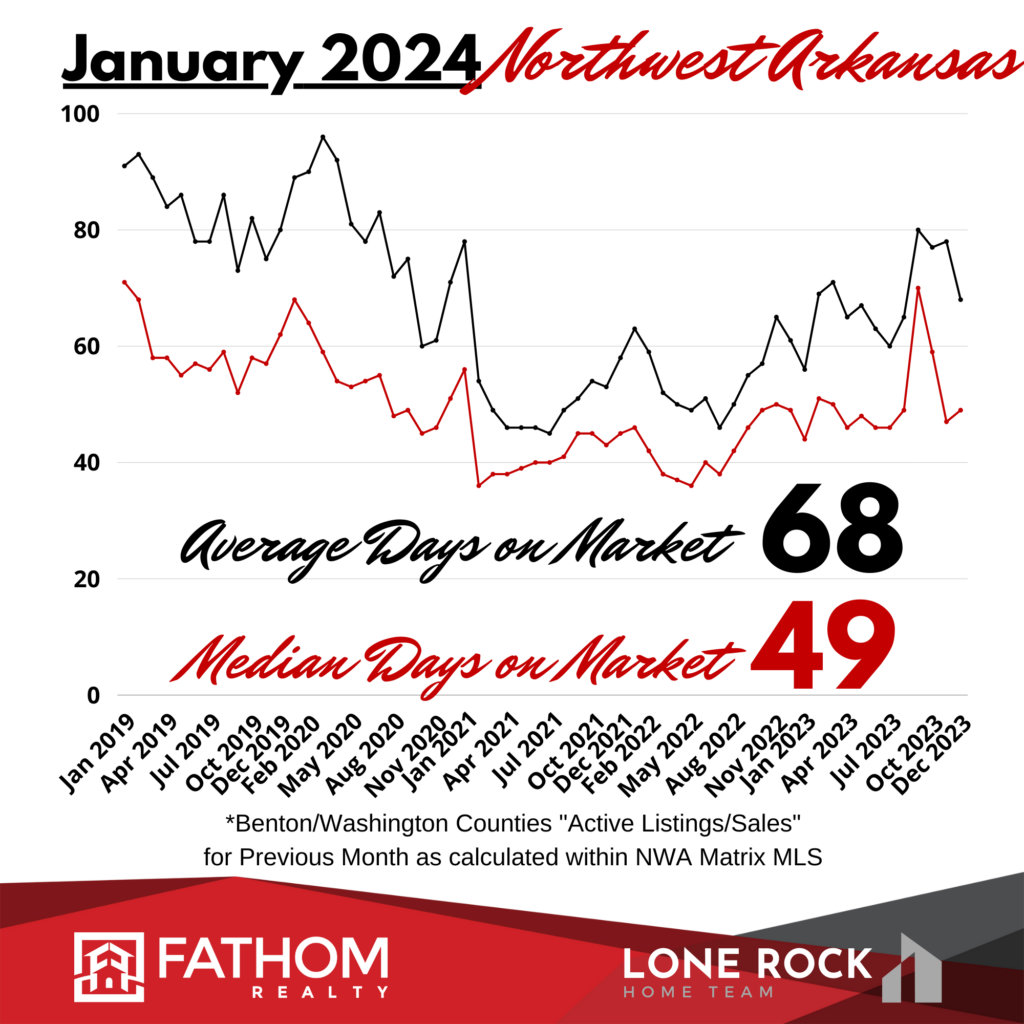

As for how long properties are staying in the market, Dedember’s Average Days came down to 68. Median Days-on-Market came in at 49 Days. And with a 30-45 Day Closing period for most transactions, this means that at least 50% of homes are still finding a contract within the first few weeks of being listed.

Now, as for Average Home Sale Prices in December we slipped to $415,000! That’s 3.6% higher than last December. That is a very normal and healthy price growth Year-over-Year.

And closing out the year at that level means we’ve spent 11 of the last 13 months at or above $400,000 on average. In 2022, there were only three months above that level. So we’ve developed and maintained a higher lever of property value here in Northwest Arkansas during 2023.

Median price hit four months in a row right at $350,000.

Now, as I’ve been saying, I expect this average pricing level to continue at or above $400,000 as we move through 2024, with modest price growth throughout this next year. As interest rates adjust lower, we may even see home prices move higher at a faster rate than we saw in 2023. More on those rate adjustments in just a minute.

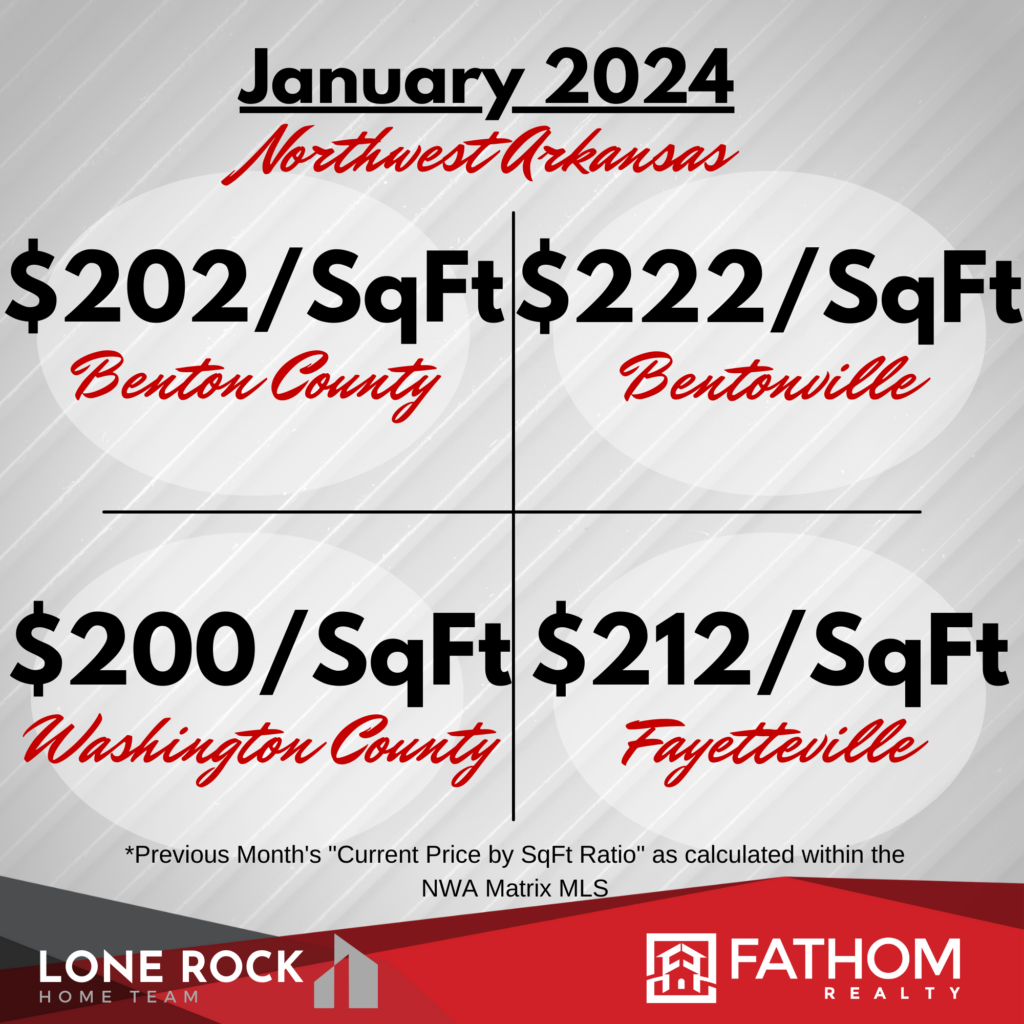

Average Prices Per Square Foot stayed around $200/SqFt this month.

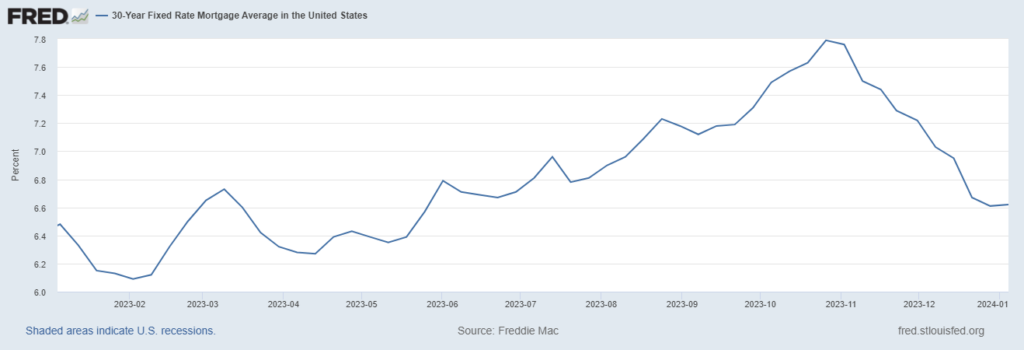

Mortgage Rates kept rising this year, but they peaked out in October at around 7.8-8%. Upon the news that the Federal Reserve is pausing rate hikes, the bond and mortgage markets reacted with a sudden drop in rates. We’re currently all the way back down to 6.6% and the upward trend has clearly been broken. Most analysts are expecting further rate declines as we move throughout 2024.

However, the higher rates created a lock-in effect for most of 2023, where current homeowners saw no benefit to selling their home and giving up their low mortgage payments, even if they really needed to make a move for family or professional reasons. Those higher rates also kept many potential buyers on the sidelines this year, creating a dampening effect on the true pent up demand for homes. A lot of professionals in the industry have said this year felt like we were working in a gridlocked market.

So, it’s going to be interesting to see how long this pent-up demand can stay stagnant. Many people are itching to make a move happen, but they’re just waiting for better conditions. As we roll into 2024, here at the LoneRock Team, we’re already starting to see an uptick of activity and clients reaching out to put their plans in place for this year.

What it all Means for You

Our Northwest Arkansas real estate market is gearing up for 2024, and many buyers and sellers are getting ready to shake things up.

We have more homes available on the market than we’ve had in previous years at this time. And that’s an opening for savvy shoppers. So I’m seeing more price reductions happening, and more room for negotiating with sellers, although average prices are still holding strong.

Remember, if mortgage interest rates continue to fall, more buyers will be coming into the market and competing for the homes that are available. So, prices will jump even higher from current levels as mortgage rates come down. Locking in a good price right now may be a smart bet. Then if you can refinance into a lower rate in the coming year, you’ll have the best of both worlds.

Some of our lender partners even have the option to do a free refinance anytime within the next two years, if rates fall substantially.

Also, we’ve put together a program to find “Hidden Inventory, Off Market Homes” for my clients without all the hassle and competition from other buyers.

This has been and will continue to be our #1 Strategy to get you and your family out of your current home and into your dream home. Let’s see what we can find together!

Just click here to learn all about the “Perfect Home Finder” Program!

If you’ve been thinking you’ll wait till later to make your move, I’d like to share a strategy to save you $20,000 to $30,000 and potentially hundreds of dollars off your monthly bills, depending on the equity position you have in your current home. Would that be a conversation worth having? If so, leave me a message below.

To see the strategies we’ve been implementing to sell for the most the market will bear, regardless of the time of year we’re in, Watch our “Pre-Listing Price Accelerator” Guide Here and see How To Maximize Your Home Sale. It will walk you through everything we’ve been doing at the LoneRock Team to get amazing results for our home sellers.

With that being said, I hope you have a great January, and we’ll catch you on the next Monthly Market Update!