As we ring in the New Year, I hope 2023 is going to be a year that fulfills your hopes and dreams, especially that Dream Home! A lot of people put their moving plans on hold last year, so you may be wondering what’s in store for our market in 2023. Well, let’s take a look back at 2022, up to the current state of the real estate market.

Last year was a rollercoaster ride that forced a lot of buyers and sellers to the sidelines. The big story last year was the interplay between inflation and interest rates. Of course, real estate is typically a great hedge against inflation, so it usually rises in inflationary. But most homeowners take on a mortgage to afford the purchase, so higher interest rates can hurt demand and suppress prices as well.

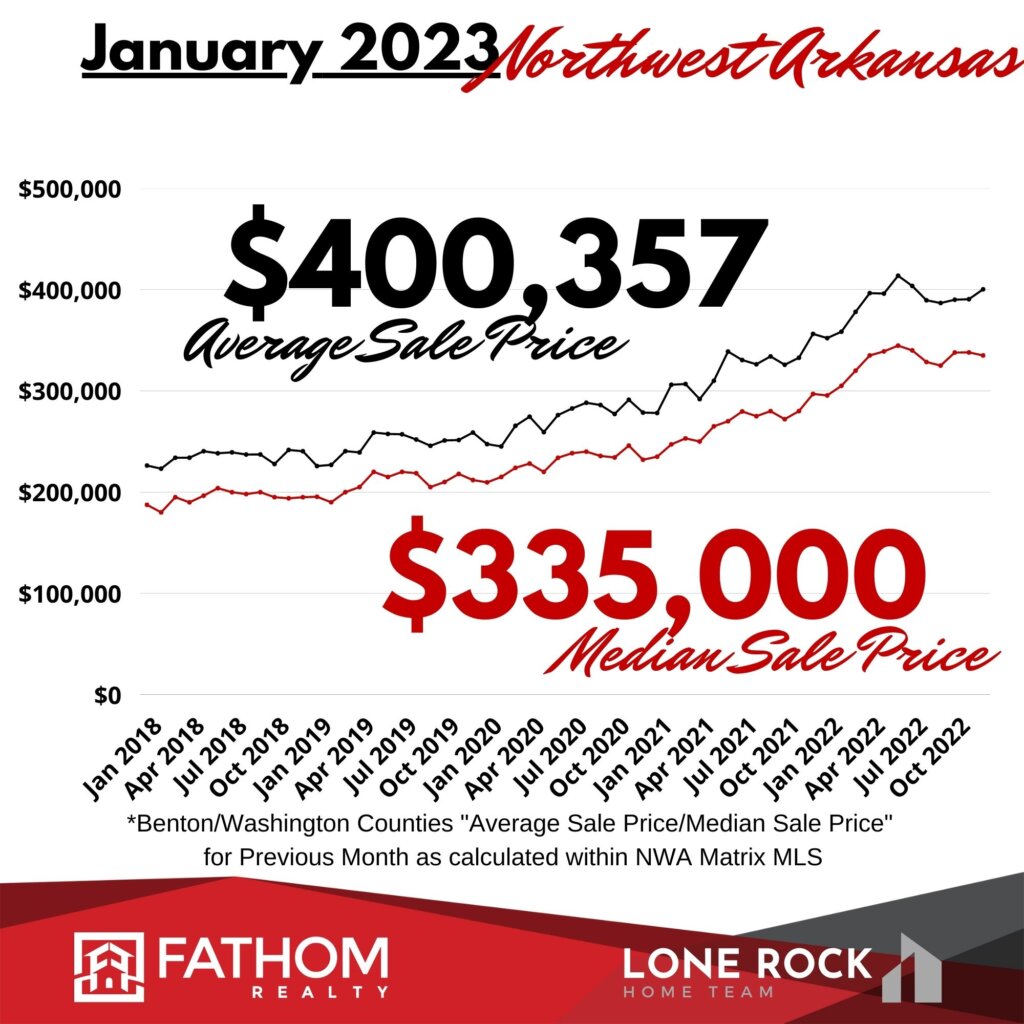

Coming into 2022 we had two years of meteoric pricing growth in our area due to the lack of supply and the rock bottom interest rates spurring abnormally large demand. So we came into 2022 with real estate prices already elevated to a high level.

Throughout the pandemic years, the Federal Reserve had unleashed a flood of money into the economy to spur growth, but in 2022 the Fed decided to get tough on its fight against inflation and started to increase interest rates. Consumers were dealing with the highest price inflation in 40 years during 2022. All household items, food, and energy surged in cost. This has been stretching household budgets to uncomfortable levels, causing many people to put necessities on credit. Savings levels fell, and debt levels rose. To make matters worse, the higher interest rates have made credit card debt even more of a burden, and any new purchases made with financing require very high payments.

However, our home prices continued to surge into the summer of last year with a peak of $413,000 in June for our Average Sale Price in the northwest Arkansas area. But as interest rates crept up into the Fall season, our average sale prices began to drop. By this time, we had the highest interest rates for mortgages that consumers had seen in almost 20 years. That drastically cut our buyer pool and scared many sellers into reducing prices in order to get a deal done. This lead to prices falling 6.5% from June to September. For those months, there was a bit of panic across the market, as it looked like these prices could drop even further.

But to many people’s surprise, our prices found a floor in October and began to bounce back in November and December. In fact, by year’s end our average sale price was $400,357, which is 12% higher than December 2021. This rebound in home prices will be particularly interesting coming into 2023, as interest rates may fall further throughout the year.

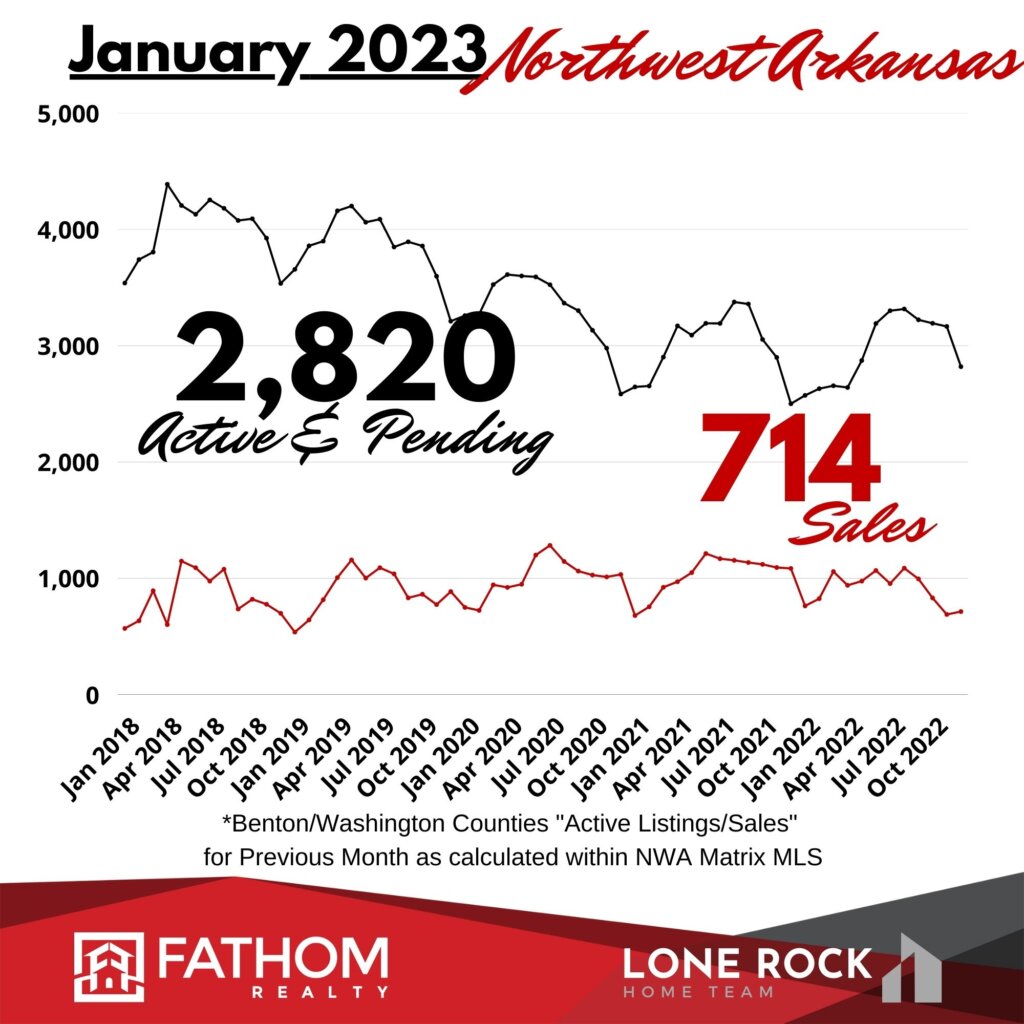

As for inventory we’re seeing slightly higher inventory levels than we’ve seen the last

two years. At this time of year, however, we’re still well below the year-over-year levels from 2019 backwards. So this is still a low inventory market. Conversely, because interest rates have affected affordability so deeply, the buyer pool is also drastically smaller than it was this time last year.

So what we’re seeing is actually a very balanced market where most homes are finding a buyer even though the frenzied days of the bidding wars are long gone. This seemed to be what helped prices rebound into the end of the year. There are many buyers who simply can’t wait any longer and are jumping on the opportunity to buy a home now, with less competition.

There’s a strong possibility that broader economic forces will worsen into the early part of 2023.

Many companies across the country have lost value in their stock prices, corporate debt is harder to take on due to higher borrowing costs, and unemployment may be on the rise.

However, the Northwest Arkansas region tends to fare pretty well, even in tough economic conditions, because our local industries provide staple goods to the rest of the country. We provide many of the consumer products, groceries, and transport needed to keep the country functioning. Plus, we’re also still getting a boost from buyers leaving the coasts and moving into middle America. Many of these buyers have sold more expensive homes in more affluent areas and are buying homes for cash here in Northwest Arkansas. The higher interest rates have little effect on this trend.

What it all Means for You

Will the Federal Reserve finally get a handle on inflation? Will interest rates be allowed to fall? Only time will tell, but for now, our northwest Arkansas real estate market seems to be holding up very well. It’s a very resilient market.

Right now, I’m seeing a big window of opportunity, especially for sellers since we’ve had prices stabilize at this higher level. If you’ve been thinking about selling, now might be a good time to consider putting real plans in place to cash out on that equity.

To see the strategies we’ve been implementing to sell for the most the market will bear, Watch my “Pre-Listing Price Accelerator” Guide Here and see How To Maximize Your Home Sale. It will walk you through everything I’ve been doing to get amazing results for my home sellers.

For buyers, even at higher interest rates, the opportunity is in getting a home without the competition from other buyers in this low inventory market. Many analysts think mortgage interest rates will fall throughout 2023. And if that happens there will once again be a flood of buyers coming into the market and competing for the few homes that are available. In that scenario, prices will go even higher. So locking in a good price right now may be a smart bet. And if interest rates happen to go lower in the future. A refinance is always a possibility.

In the meantime, mortgage programs like a 2-1 Buy Down may be helpful for keeping payments low in the short term. In that program, your interest rate is two points lower in the first year and one point lower in the second year before finally settling at the base interest rate in the third year. Our lender partners can fill you in on all the details if this would be a good option for you.

Also, I’ve put together a program to find “Hidden Inventory, Off Market Homes” for my clients.

This is my #1 Strategy to get you and your family out of your current home and into your dream home. Let’s see what we can find together!

Just click here to learn all about the “Dream Home Finder” Program!