Welcome to our February 2024 Monthly Market Update. Here we are during the month of love with the most romantic holiday around, Valentine’s Day of course. And maybe you’re thinking of falling in love with the perfect home this year. So, if that’s the case make sure to stick with me to the end of this article because we have a lot of great information about the housing market, and all the shifts and changes that are happening right now. So grab a box of chocolates and some candy hearts and let’s Dive In.

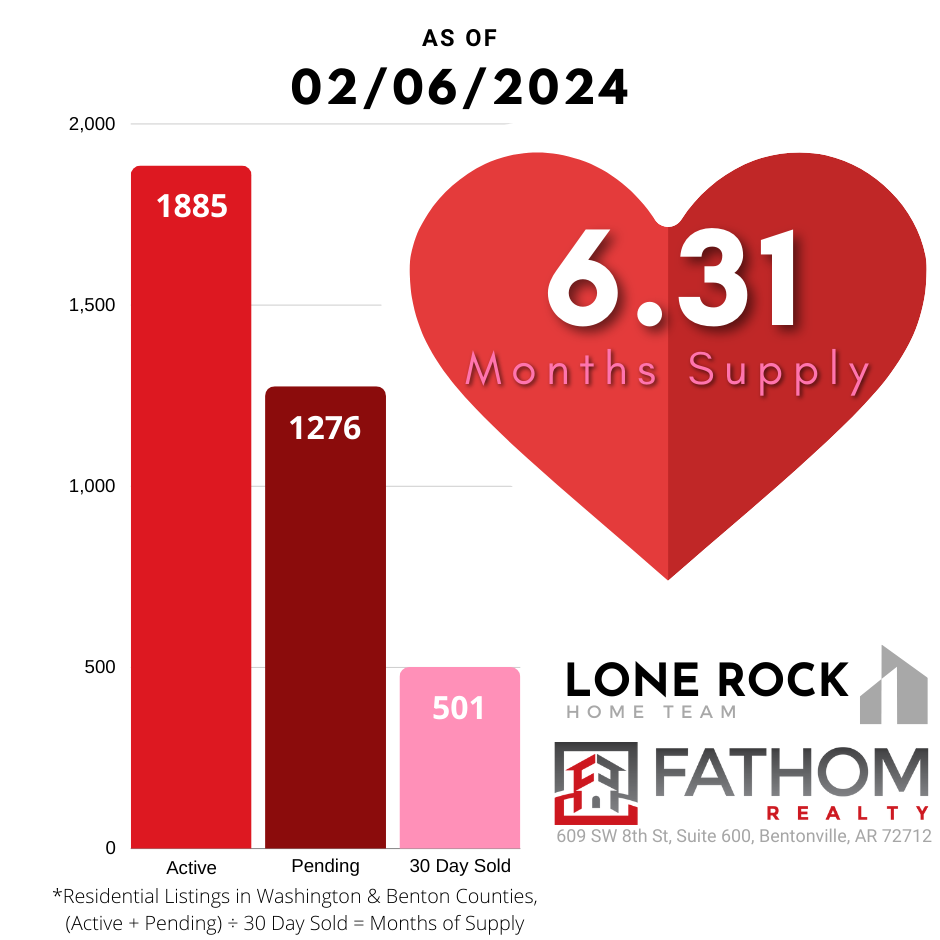

Let’s start with our inventory levels. In February 2024, we find ourselves with approximately 6.31 months of supply for homes in our market. Now that is indicating a fairly even balance between supply and demand. This is neither a seller’s market nor a buyer’s market. This uptick in inventory compared to previous months is giving us a more neutral market dynamic right now.

This is largely due to the slowdown in home shopping during the holidays, which resulted in a low number of closings happening in January. Now that’s very typical, as January usually has the lowest closing number every year. But we’ve seen a surge in homes coming into the market last month as well, so the higher Supply number divided by the lower Closing number makes our Months of Supply metric rise to these levels.

We do expect that number to drop again, into the coming months as more and more closings take place into the Spring. By early Summer, we expect to be back into a strong Seller’s market.

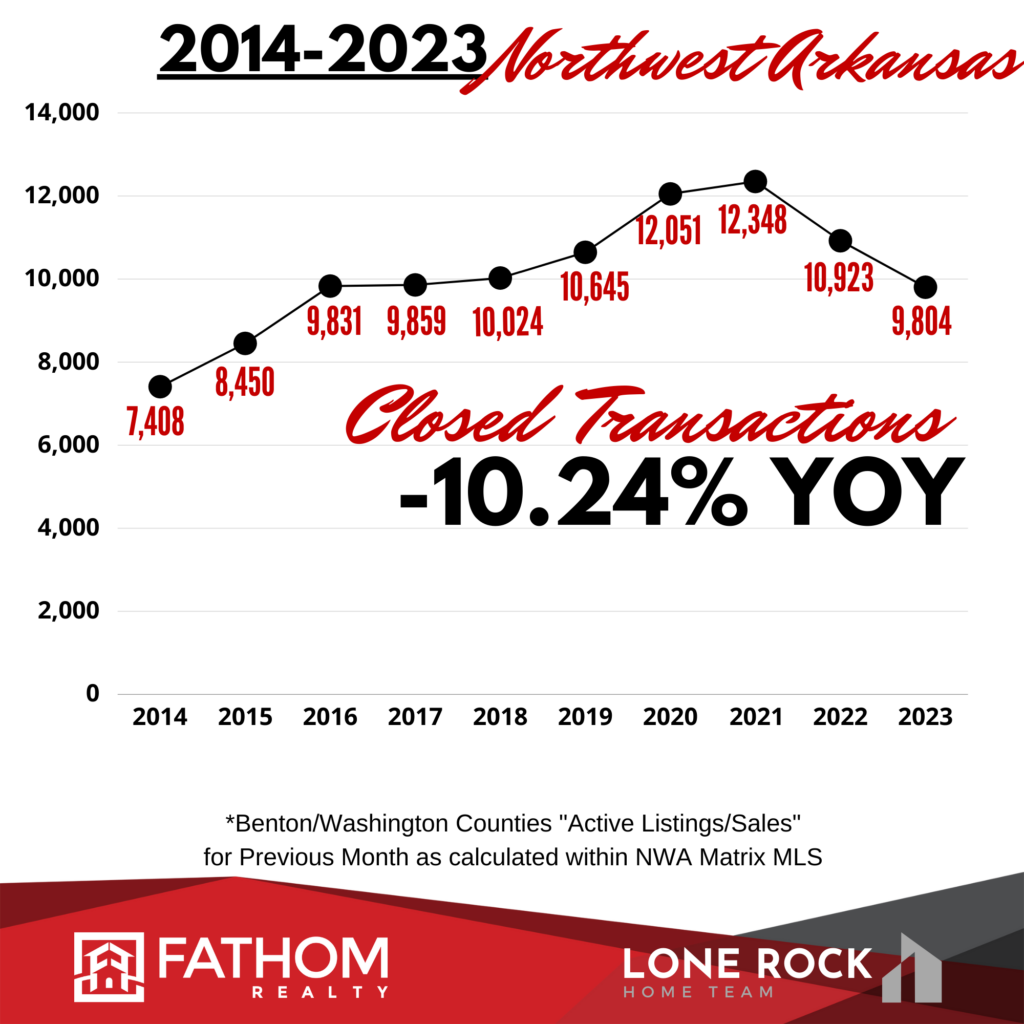

If we look at the Yearly transactional data, we’re seeing some intriguing patterns. The total number of closings in 2023 dipped all the way down to 9,804 from 10,923 in 2022, marking a 10.24% decrease year-over-year. We have to go all the way back to 2015 to find a slower selling year.

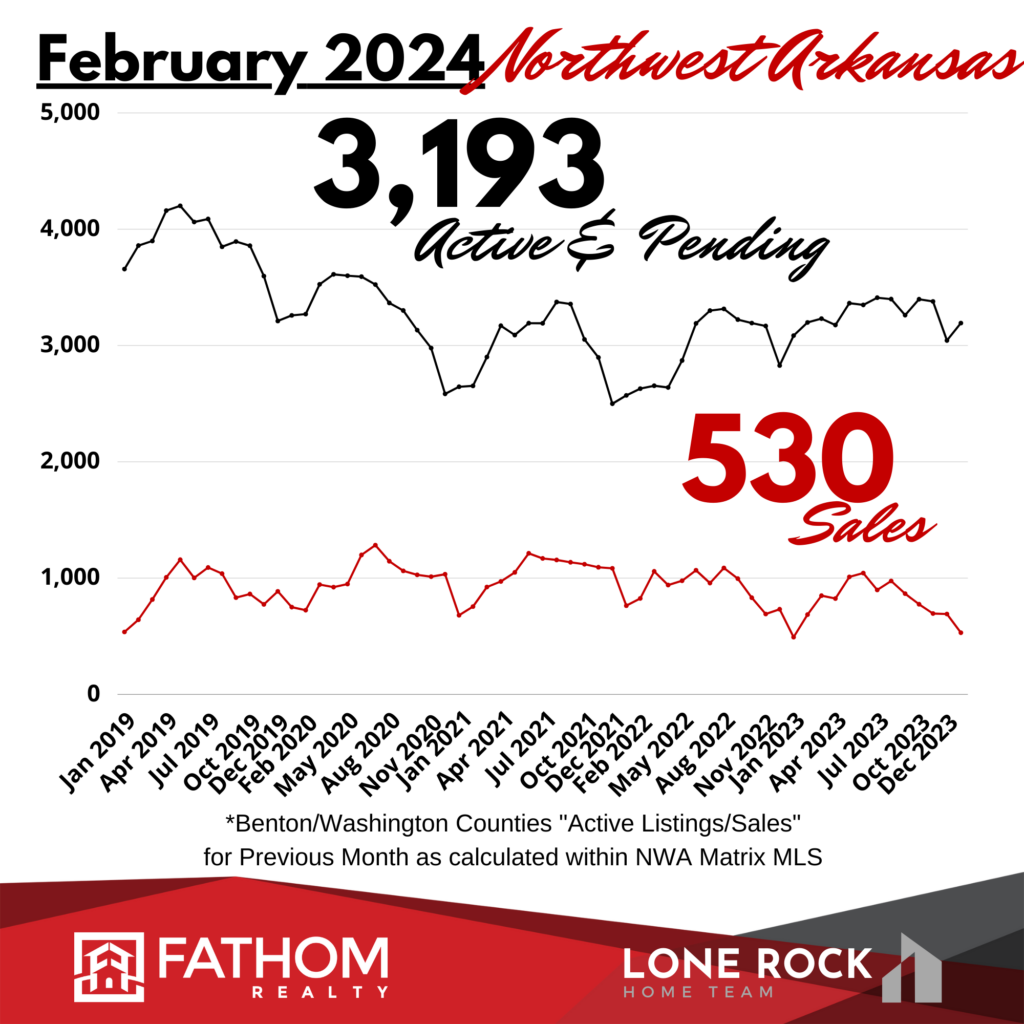

With 530 sales recorded in January, that lower trend is continuing into 2024. However, most of these lower sales numbers in 2023 may have simply been due to lower supply. We just didn’t have many homes available last year because many potential home sellers, people who might really need to make a move, held off because of the interest rates and the payment shock they would experience if they made that move. But with 3,193 active and pending listings, we’re starting to see more supply in our market.

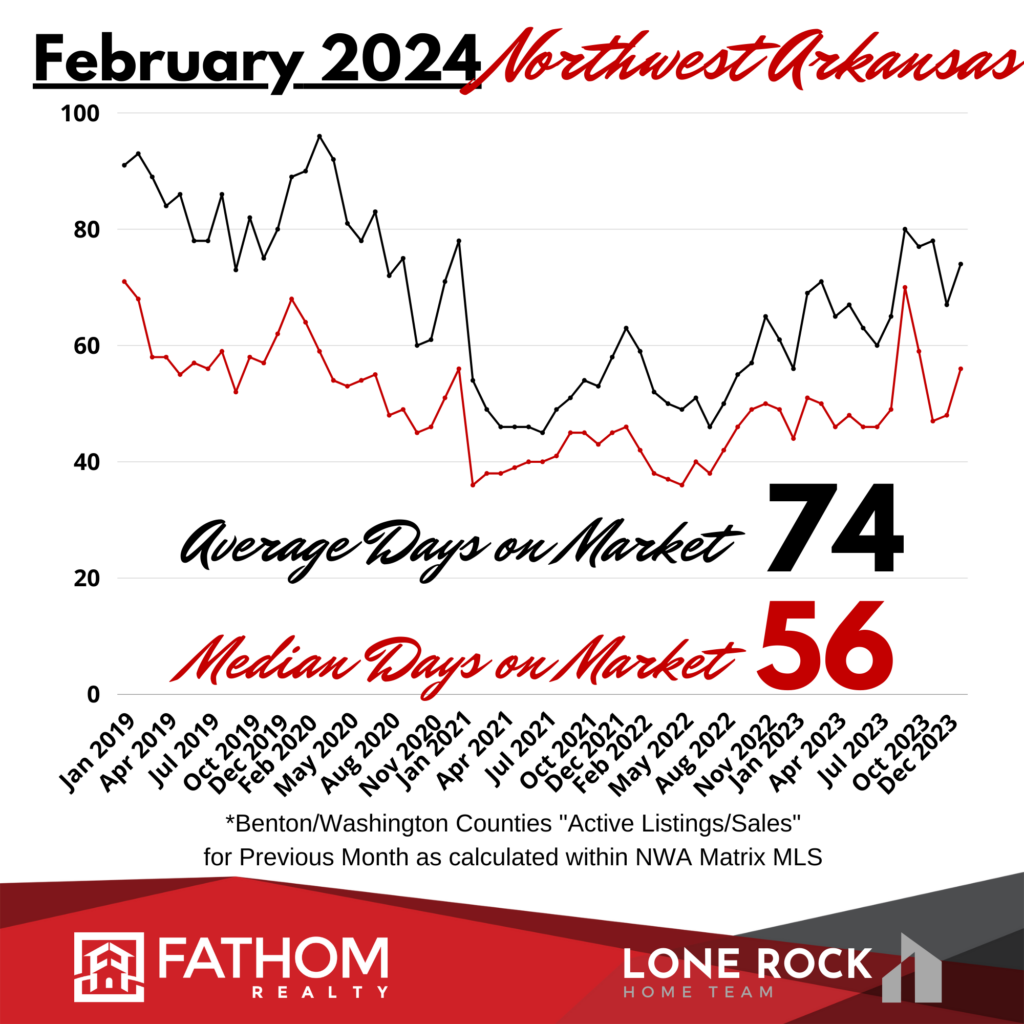

In January, the average days-on-market clocked in at 74 days, while the median days-on-market stood at 56 days. This is in line with what our market was like before the Covid era, back in 2019. So, properties are still moving pretty quickly once they hit the market, with a significant portion finding buyers within the first few weeks of listing. But it’s definitely a slower pace than the frenzy we saw in late 2020 and throughout 2021.

As for pricing, January saw an Average Sale Price of $404,980 and a Median Sale Price of $340,450. Despite the interest rates rising, we still had more Buyers than Sellers last year, so even though we have seen lower numbers of transactions, the demand for homes has actually outpaced our local supply. This has kept our prices rising, even as the market volume contracts.

Now, as I’ve been saying, I expect this average pricing level to continue at or above $400,000 as we move through 2024, with modest price growth throughout this next year. As interest rates adjust lower, we may even see home prices move higher at a faster rate than we saw in 2023. More on those rate adjustments in just a minute.

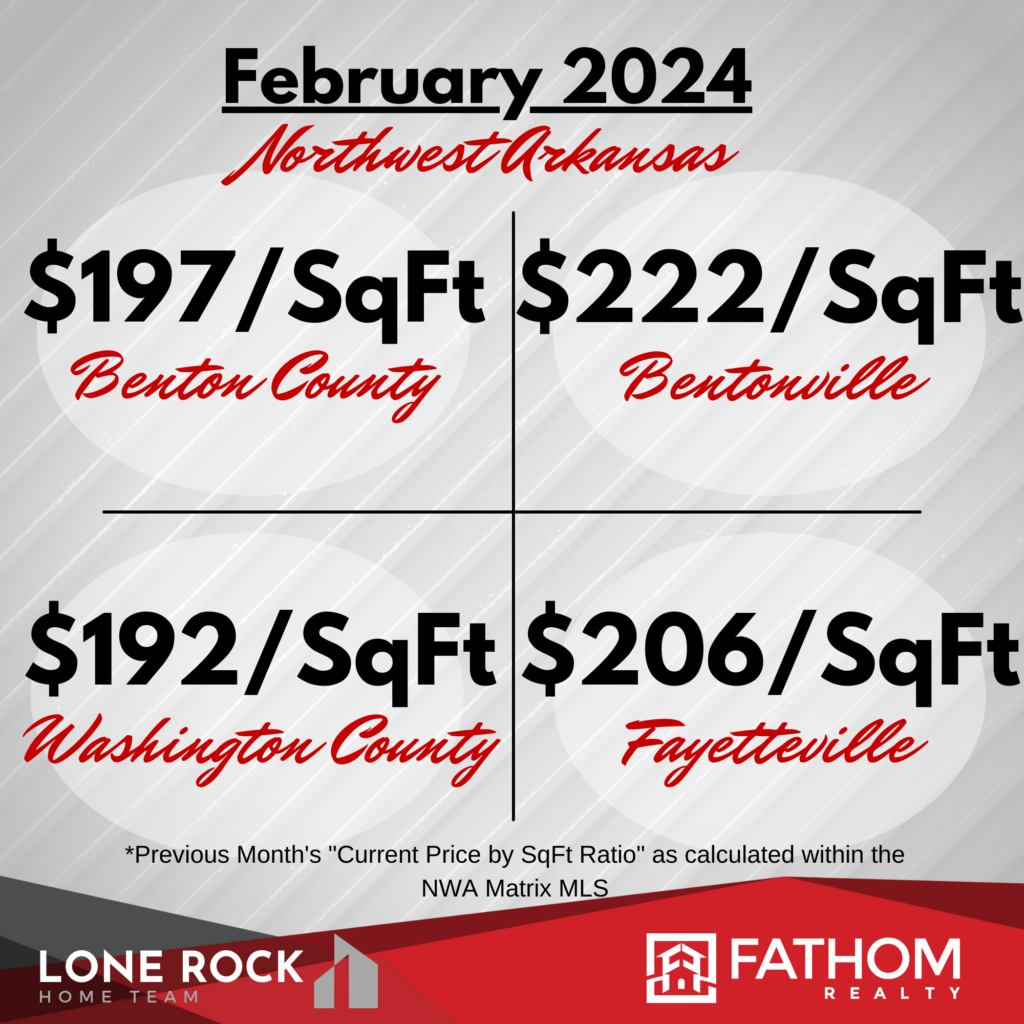

Average Prices Per Square Foot stayed around $200/SqFt this month.

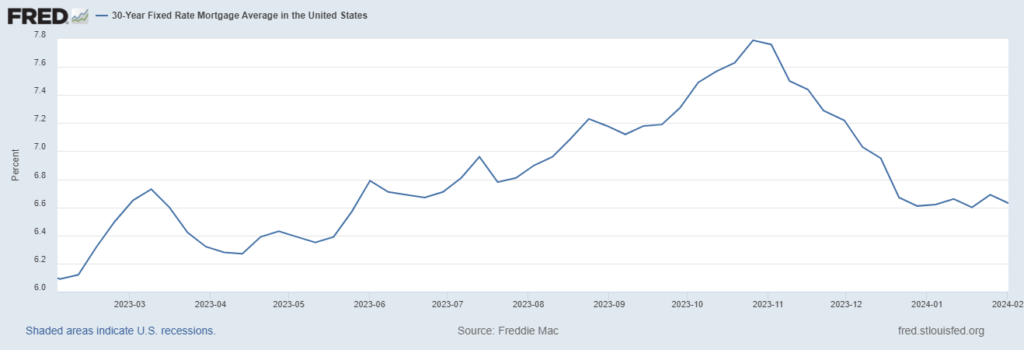

In the realm of financing, the 30-year fixed-rate mortgage average in the United States remained steady around 6.6%, leveling off at these borrowing conditions for the last month or so. However, the overall trend and industry forecasts are suggesting rates to go lower over the coming year, so we expect a lot more buyers to come into the market this Spring and Summer.

Again, the higher rates created a lock-in effect for most of 2023, where current homeowners saw no benefit to selling their home and giving up their low mortgage payments, even if they really needed to make a move for family or professional reasons. Those higher rates also kept many potential buyers on the sidelines this year, creating a dampening effect on the true pent up demand for homes. That’s what caused our number of Closings to contract for the last two years.

So, it’s going to be interesting to see how long this pent-up demand can stay stagnant. A lot of people are itching to make a move happen, and they’re finally deciding to jump in. As we roll into 2024, here at the LoneRock Team, we’re already starting to see an uptick of activity and clients reaching out to put their plans in place for this year.

What it all Means for You

As we move ahead into the remainder of 2024, it’s essential for both buyers and sellers to stay adaptable and informed. While the market landscape may shift, there are a lot of opportunities for those willing to jump on them. So, whether you’re in the market for your dream home or considering selling your property, or both, all of us here at the LoneRock Team at Fathom Realty would love to assist you every step of the way.

Also, we’ve put together a program to find “Hidden Inventory, Off Market Homes” for my clients without all the hassle and competition from other buyers.

This has been and will continue to be our #1 Strategy to get you and your family out of your current home and into your dream home. Let’s see what we can find together!

Just click here to learn all about the “Perfect Home Finder” Program!

To see the strategies we’ve been implementing to sell for the most the market will bear, regardless of the time of year we’re in, Watch our “Pre-Listing Price Accelerator” Guide Here and see How To Maximize Your Home Sale. It will walk you through everything we’ve been doing at the LoneRock Team to get amazing results for our home sellers.

To wrap up, February 2024 holds a lot of promise and potential for our Northwest Arkansas real estate market. With inventory levels stabilizing, and pricing remaining resilient, there’s a lot to be optimistic about as we move through this new year. So, thanks for checking this Monthly Market Update. We’ll catch you on the next one!