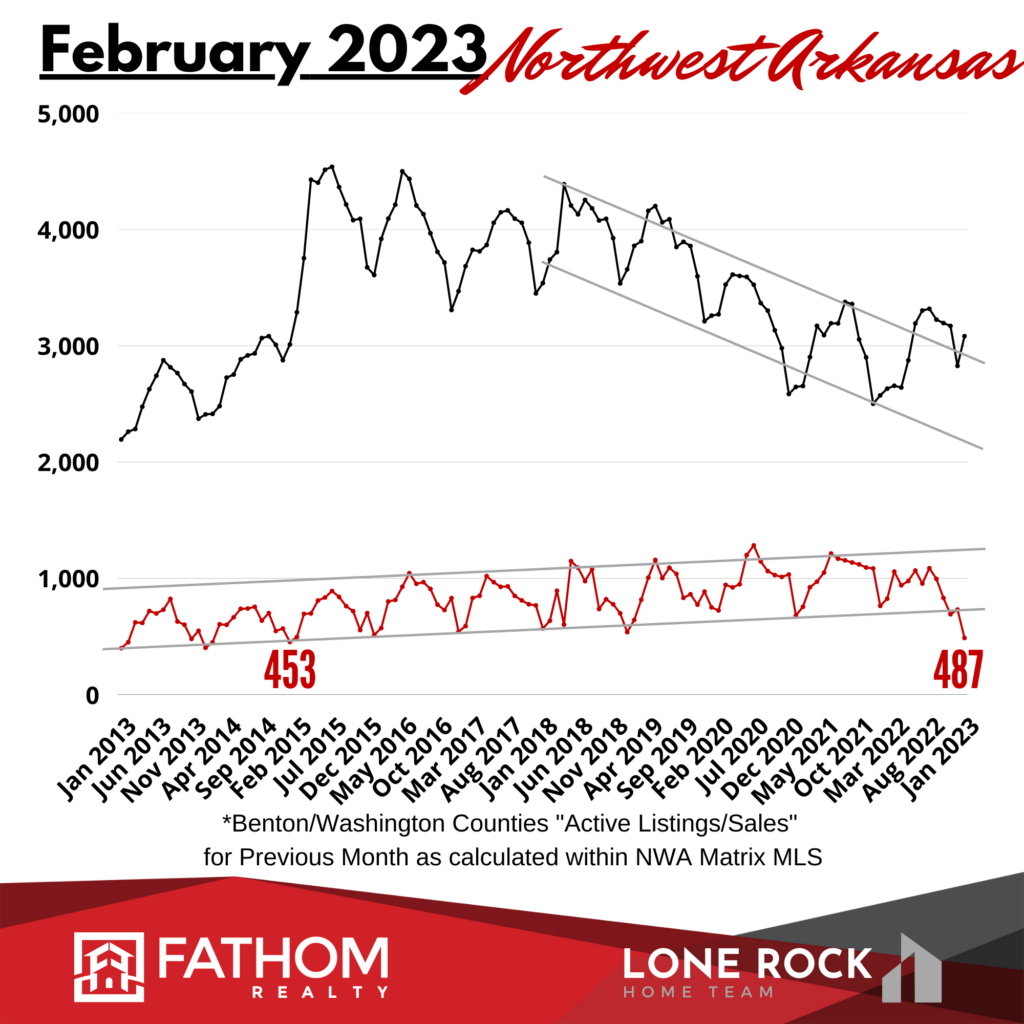

As we get rolling into 2023 here in Northwest Arkansas, our Real Estate market is coming back to life. After the Fed’s interest rate hikes over the course of last year, the shock of higher mortgage payments rippled through our market and froze many would-be home buyers in their tracks. This lead us into one of the lowest numbers of transactions in several years, as we’ll see later in the article.

However, throughout January and the first part of February we’re starting to see a flood of buyers coming back into the market. They’ve finally come to grips with the payments they’ll need to make in order to own a home, and the milestones of life are forcing many to jump into the market even at an unfavorable interest rate.

As for what effect this is having on prices, we may be looking at a flat market for the first part of this year. If interest rates rise from here, we’ll see continued downward pressure on pricing. If rates fall, prices will rise as a result.

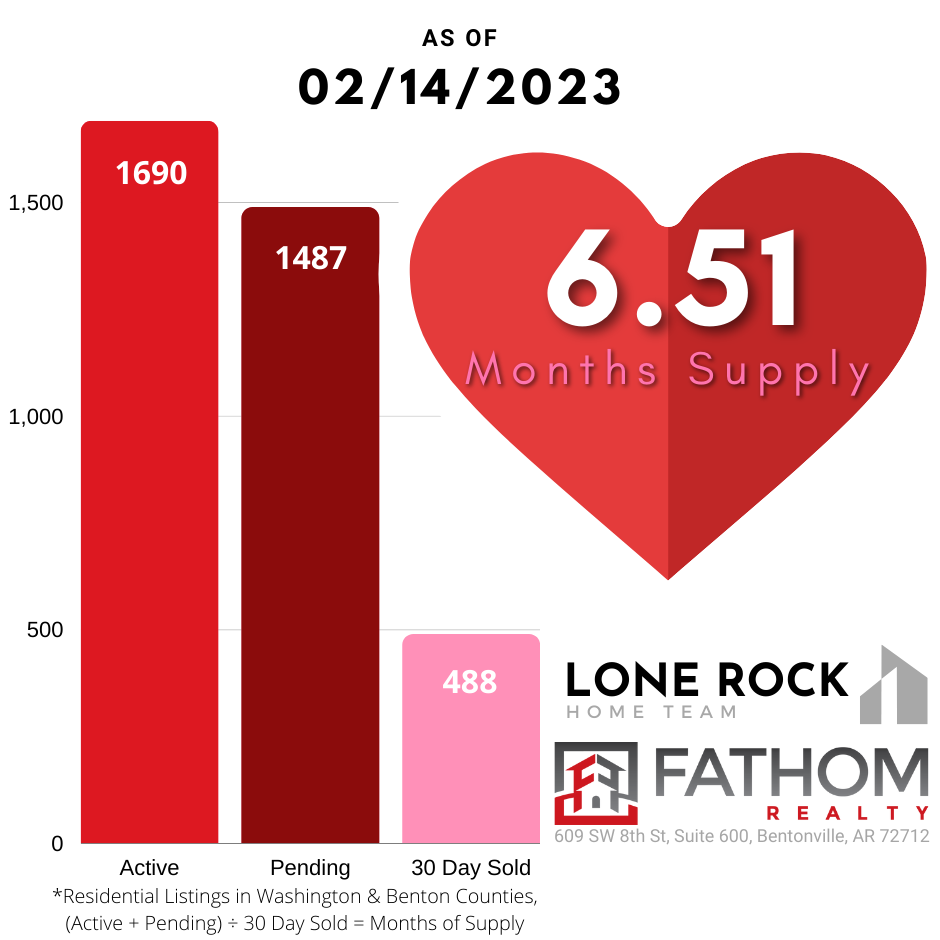

Demand for homes is very strong in our region. Although there’s more inventory than we’ve seen in a few years, we’re actually experiencing a very balanced market now. As the rate shock subsides, more buyers will be rejoining the market this Spring.

NWA home prices have clearly broken the trend of going higher and higher every quarter. Now we’re seeing the market reset and starting to trend sideways. It looks very similar to the flat trend in 2018, which was also a year of interest rates rising.

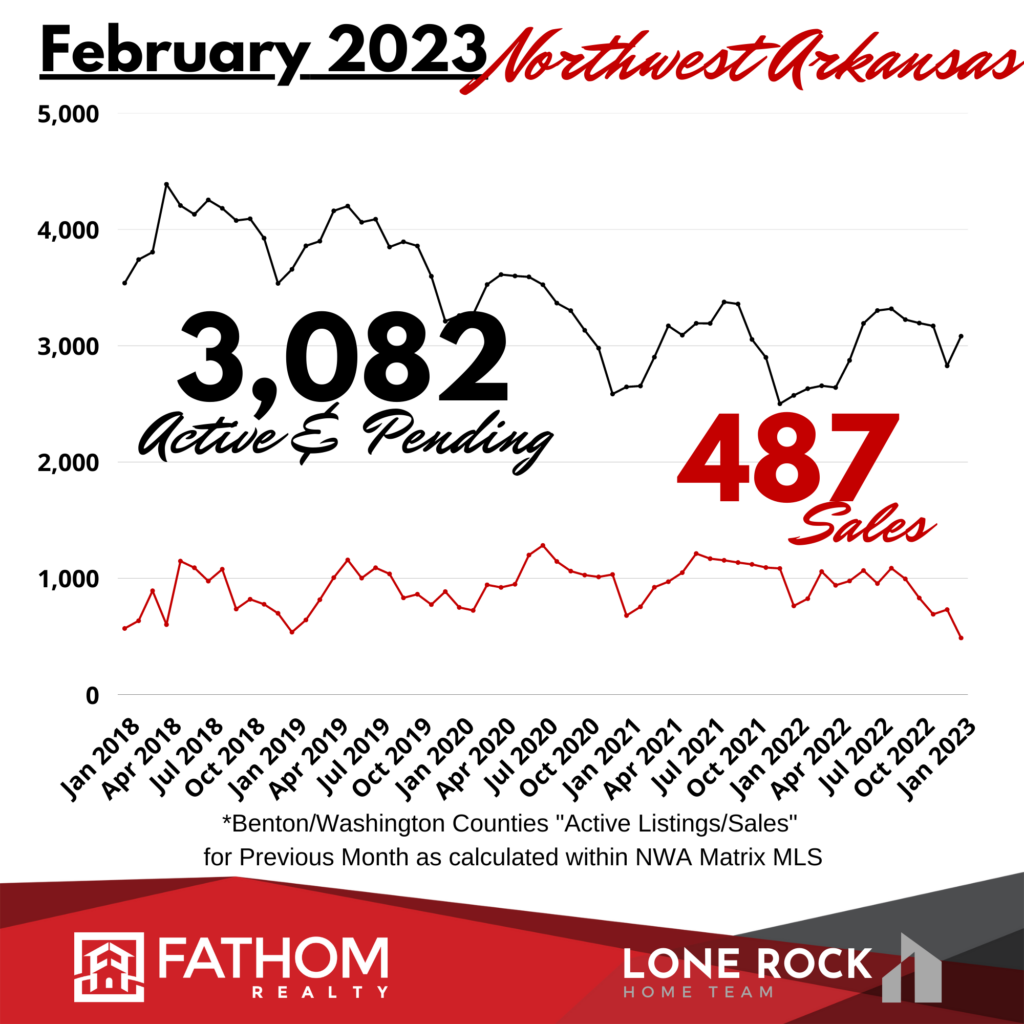

In January, our average sale price was $386,173, which is still 9.66% higher than January 2022. These home prices seem to have found a plateau at this elevated level for now. Most analysts are expecting prices to hold at this level for a while, as supply and demand seem to have balanced each other out. When graphed, This looks like a stark reversal of the trend of lower inventory numbers and higher sales numbers that we’ve been watching play out for the last 3-4 years.

| Number of Homes Sold | |||

|---|---|---|---|

| 2021 | 2022 | Change | |

| February | 755 | 825 | 9.27% |

| March | 923 | 1,058 | 14.63% |

| April | 971 | 940 | -3.19% |

| May | 1,049 | 977 | -6.86% |

| June | 1,213 | 1,067 | -12.04% |

| July | 1,169 | 955 | -18.31% |

| August | 1,155 | 1,087 | -5.89% |

| September | 1,136 | 995 | -12.41% |

| October | 1,120 | 831 | -25.80% |

| November | 1,093 | 691 | -36.78% |

| December | 1,085 | 732 | -32.53% |

| January | 763 | 487 | -36.17% |

As for inventory we’re seeing slightly higher inventory levels than we’ve seen the last

few years. At this time of year, however, we’re still well below the year-over-year levels from 2019 backwards. So this is still a low inventory market.

Conversely, because interest rates have affected affordability so deeply, the buyer pool is also drastically smaller than it was this time last year. In fact, the number of transactions shrank dramatically in January to a level not seen since 2015.

So what we’re seeing is actually a very balanced market where most homes are finding a buyer even though the frenzied days of the bidding wars are long gone. This seemed to be what helped prices rebound into the end of the year last year. There are many buyers who simply can’t wait any longer and are jumping on the opportunity to buy a home now, with less competition.

In fact, we’re seeing mortgage applications rising now, and I saw several multiple offer situations in January. So, I’m expecting the February closing numbers to be much higher than this January low. The buyer pool is getting its second wind right now, and the Spring market should have fairly strong sales numbers.

What it all Means for You

Will the Federal Reserve finally get a handle on inflation? Will interest rates be allowed to fall? Only time will tell, but for now, our northwest Arkansas real estate market seems to be holding up very well. It’s a very resilient market.

Right now, I’m seeing a big window of opportunity, especially for sellers since we’ve had prices stabilize at this higher level. If you’ve been thinking about selling, now might be a good time to consider putting real plans in place to cash out on that equity.

To see the strategies we’ve been implementing to sell for the most the market will bear, Watch my “Pre-Listing Price Accelerator” Guide Here and see How To Maximize Your Home Sale. It will walk you through everything I’ve been doing to get amazing results for my home sellers.

For buyers, even at higher interest rates, the opportunity is in getting a home without the competition from other buyers in this low inventory market. Many analysts think mortgage interest rates will fall throughout 2023. And if that happens there will once again be a flood of buyers coming into the market and competing for the few homes that are available. In that scenario, prices will go even higher. So locking in a good price right now may be a smart bet. And if interest rates happen to go lower in the future. A refinance is always a possibility.

In the meantime, mortgage programs like a 2-1 Buy Down may be helpful for keeping payments low in the short term. In that program, your interest rate is two points lower in the first year and one point lower in the second year before finally settling at the base interest rate in the third year. Our lender partners can fill you in on all the details if this would be a good option for you.

Also, I’ve put together a program to find “Hidden Inventory, Off Market Homes” for my clients.

This is my #1 Strategy to get you and your family out of your current home and into your dream home. Let’s see what we can find together!

Just click here to learn all about the “Dream Home Finder” Program!