This Summer heat has just added fuel to the fire of our local Real Estate Market. Just when it looks like things can’t get any hotter, we keep breaking records!

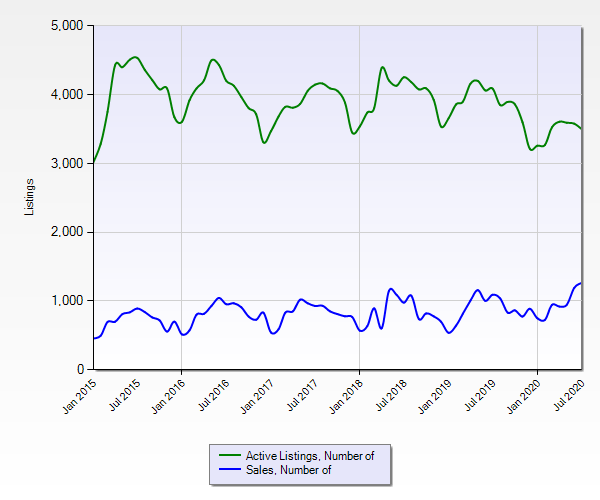

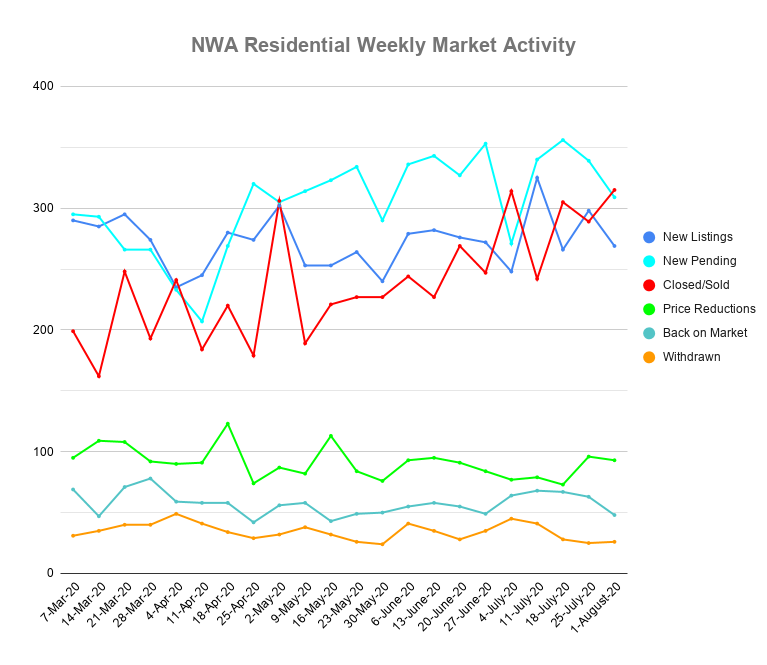

We sold a record 1,218 Residential properties across Washington and Benton Counties in July. As I type this on the morning of August 6th, we only have 1,227 in the market! That means we only have about 1 Month of Supply right now.

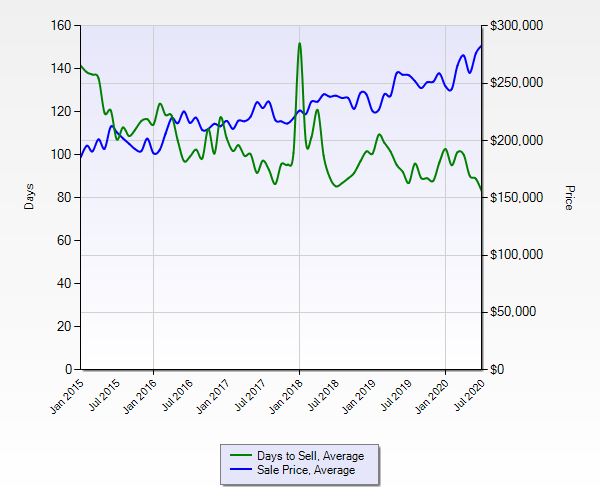

This extreme Seller’s Market produced an average sale price of $284,942 in July, the highest ever recorded for our area. This is coming right after the record we set in June at $276,361.

As I mentioned last month, this historic low supply and sustained high demand has resulted in bidding wars with multiple buyers trying to win the properties. I’ve seen many properties going for $10,000 over the listed price (or more.) We’ve been in this highly competitive environment for months now, with New Pending sales outpacing New Listings entering the market every week for the last 13 weeks.

Major Forces

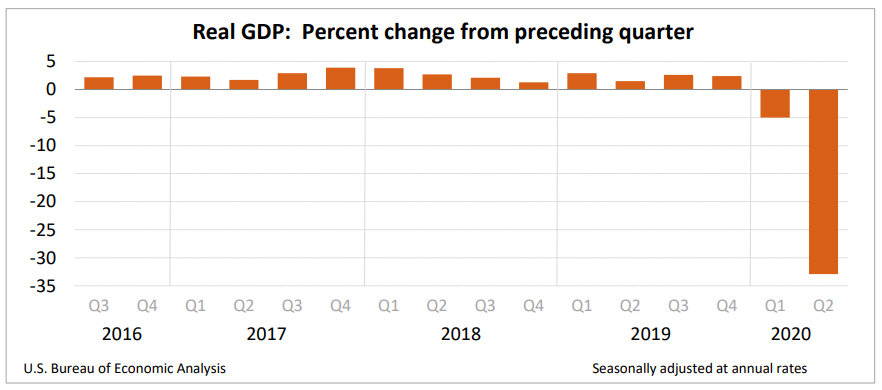

While the numbers above continue to look rosy for homeowners in NWA, if I’m honest, I’m actually pretty worried for the broader economy and the future of our country right now. After the worst quarter in history (Q2 2020) with an annualized contraction in GDP (Gross Domestic Product) of 32.9%, it seems Main Street America is in trouble, even though Wall Street has begun to recover.

Jobs and Relocation

Nationally, we’re seeing mass numbers of people leaving large Metro areas and relocating to more rural areas. The high density is dangerous for the spread of Covid, and the once plentiful job prospects in big cities have started to dry up. I could see a rise in people trying to move here to NWA as a result of these trends.

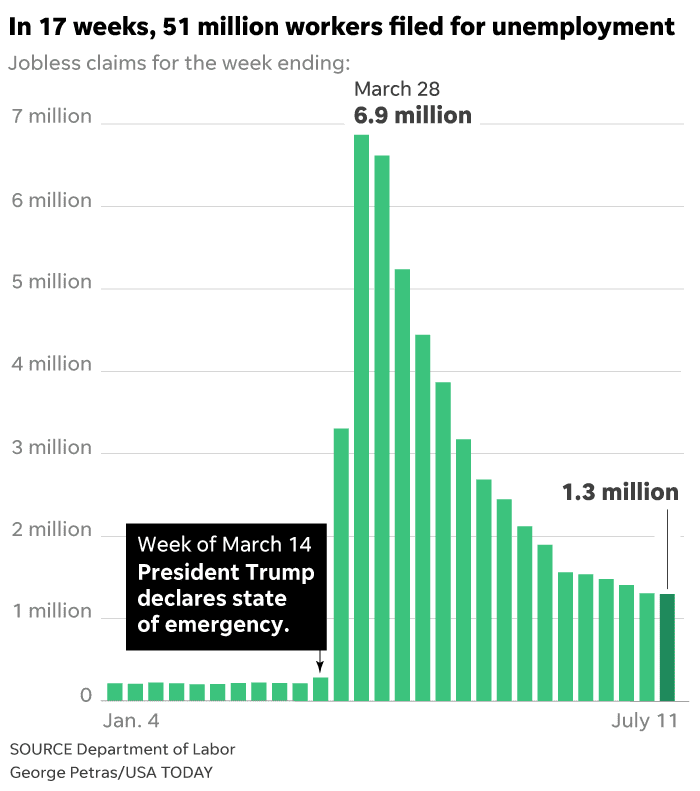

Nationally, the employment numbers haven’t recovered as much as was hoped, and rehiring slowed in July. Somewhere between 20 million to 30 million Americans still remain unemployed. Of course, the hospitality, restaurant, and front line retail workers were the hardest hit at first. However, with continually low consumer spending, the job losses are moving into our manufacturing sector along with major corporations shedding office positions and restructuring to run more lean operations.

We haven’t escaped this in Northwest Arkansas. We’re now starting to experience those corporate level job losses. After the recent layoffs at the Wal-Mart home office, we could see a few more homes hitting the market as some families relocate.

Even without the employment aspect, I’ve seen people who weren’t originally from here selling and moving back to the wherever their extended family resides. Family and connection have become major motivators for people during these times as well. This is a continuation on the “Flight to Safety” theme I discussed last month.

In fact, I personally have a property under contract with an out of state buyer trying to move to NWA to escape high prices and overcrowding of a bigger metro, and a seller who is moving back to another state as well. So, there’s a lot of shifting and relocating going on in both our local and our broader economy right now. People are really re-evaluating their lives and examining what is really important to them.

Governmental Response

At the outset of the pandemic, a historically large response from the US Government set the stage for what has unfolded over the last few months. And now, it appears that governmental support may be waning. The $600 enhanced unemployment was keeping many Americans afloat, and that ended on July 31st. Congress seems split on how to extend that program, and even though they supposedly have a deadline tomorrow (August 7th), so far they’ve still had a lot of disagreement about these benefits.

Regardless of political affiliation, the fact is that if those payments are reduced or go away completely, many Americans are going to suffer financially, and consumer spending will fall further. This is a reality we must begin to prepare for. The bigger implication of continued low levels of consumer spending is more job losses as companies can’t meet their payrolls and overhead expenses if they aren’t selling as much. All of these factors are interconnected.

Evictions and Foreclosure

Part of that initial governmental response was protections on evictions and foreclosures. This was done to keep people in their homes and rentals as long as possible, and it has already strained our banking system and many landlords across the US. On July 31st, the eviction moratorium was lifted and now more than …

Likewise, Forebearances were put in place for homeowners who had trouble paying their mortgage, which had an initial period of 6 months and can be extended for another 6 months. The first deadline hits this fall, around October, and could lead to more homes being put on the market in an attempt to sell the house to avoid being foreclosed upon. The second and more definite deadline will be in the Spring of 2021.

Many potential home buyers have been expecting prices to fall, and I do believe that will happen, but I don’t see it hitting in full effect until these foreclosure sales start to hit the market next year. And even then, who knows if the government will step in again to avoid another housing crisis. There’s a lot of uncertainty around the housing sector at the moment.

What it all Means for You

If you’ve been thinking of selling your home, PLEASE listen to me. We may be close to a price peak right now. We don’t know exactly how all this will play out. Hopefully, our record high prices can withstand the economic storm that has been brewing during this pandemic.

However, that may not be the case, and we may see prices fall later this year or next year. You may not be able to sell your home at these kinds of prices if you miss this window of opportunity.

If we do see a price decline in Real Estate, there’s no telling how long it may take to recover. This decline won’t look exactly like the last Recession, but there are lessons to be learned from it. In that one, it took Real Estate 7 to 8 years to get back to the previous highs.

Are you prepared to stay in your current home for the next 7-10 years? Is it the best possible living situation for you and your family? If not, let’s chat. I want you to make it through in the best possible position.

I book Free Strategy Sessions for all my clients. No pressure or obligation, but I’d be happy to help you put a solid plan in place to guide you through these uncertain times.

Would it make sense to chat for a few minutes?

Just book a FREE Strategy Session with me Here to block out your own time on my calendar.

You could also Send me a message or give me a call today! (479) 777-3379