Spring has Sprung here in NWA and our Real Estate market is back to breaking records with our March market data!

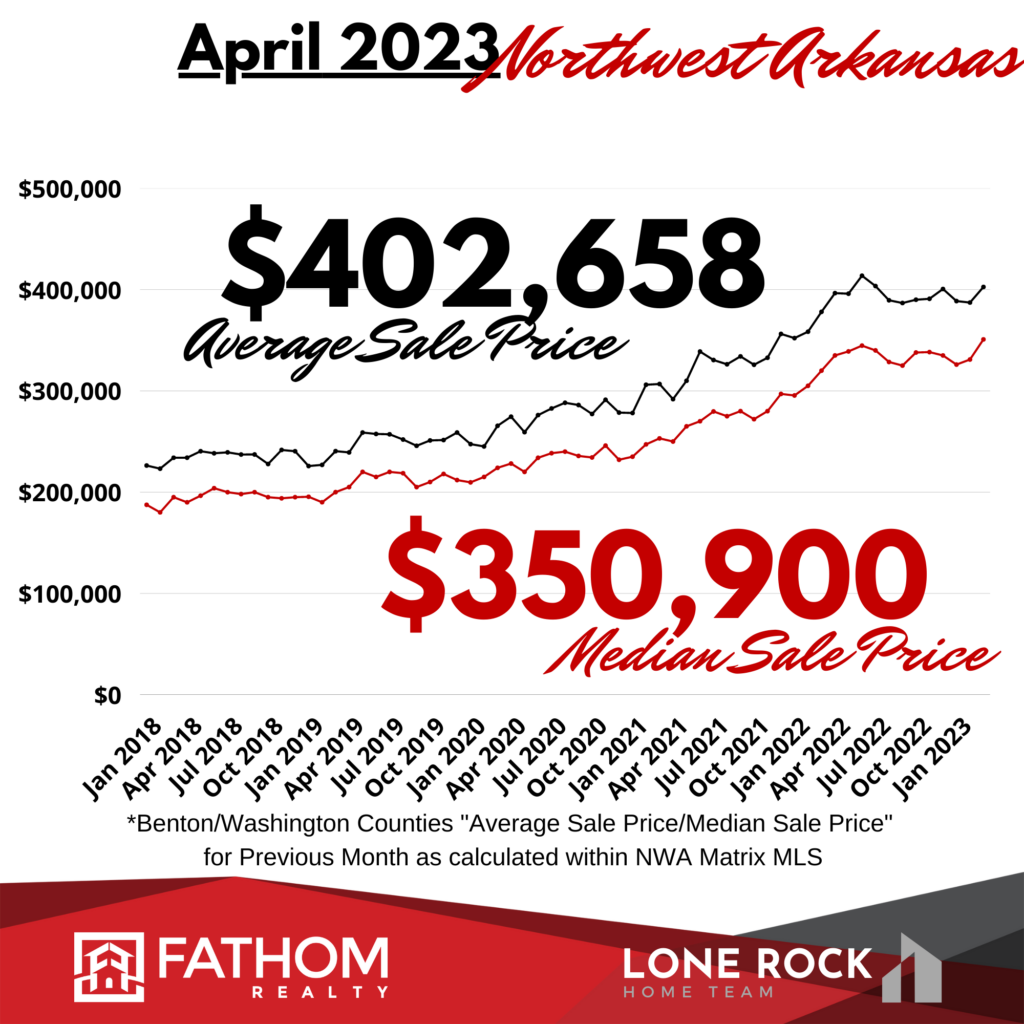

In fact, the Median price for homes across Washington and Benton Counties went up to a new all time record of $350,900. More on that in just a moment.

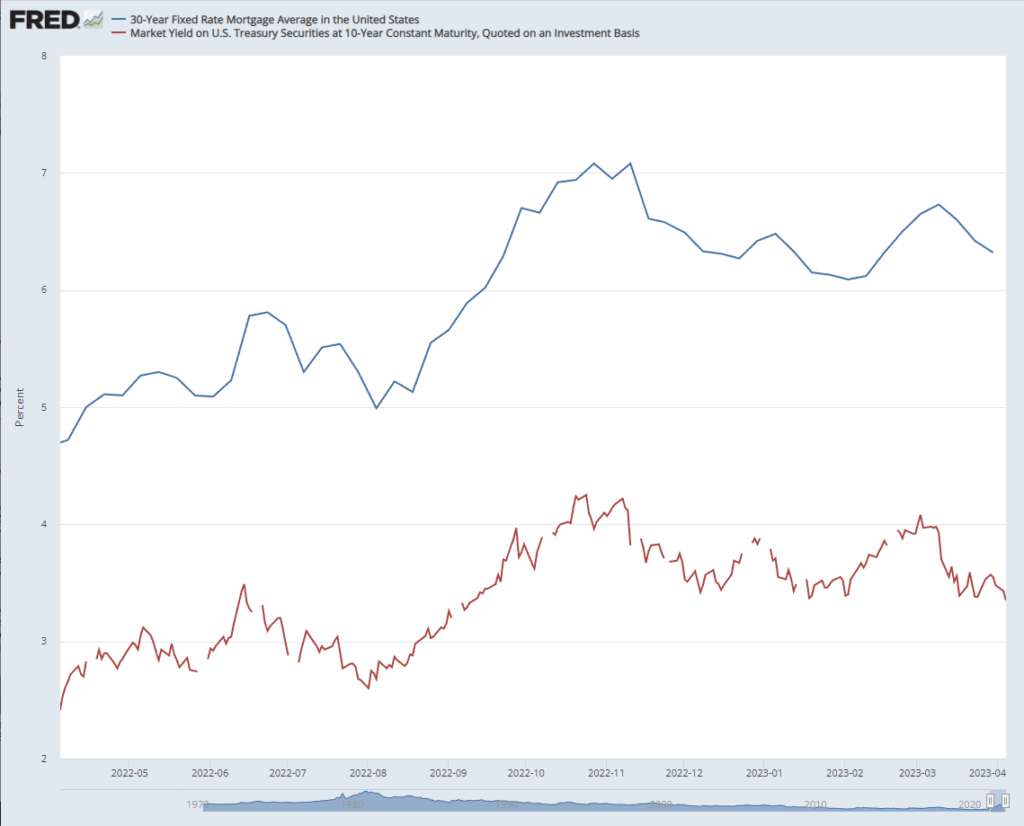

We’re seeing a surge of buyers flooding the market, continuing the trend from back in January and February. Many buyers are taking advantage of the dip in mortgage rates and we’re even seeing the resurgence of multiple offers on desirable properties.

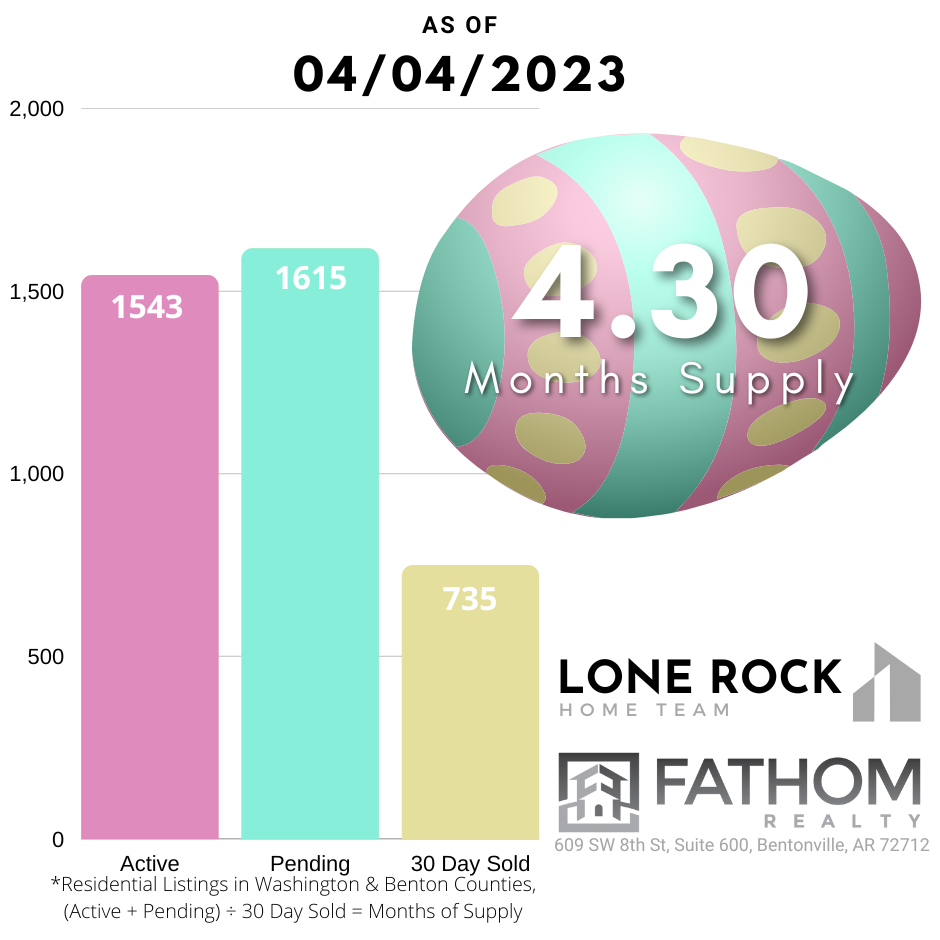

As I predicted, the number of homes closing in March increased over the previous few months. We started the year with 6.45 Months of Inventory, and now we’re all the way down to 4.30 Months.

In fact, as you can see, we now have more homes getting contracts (going Pending) than the number of Active homes in the market. That’s an indication that our inventory metrics will soon drop lower, below 4 months of inventory. This means we are swiftly moving into a Seller’s Market coming into the Spring Selling Season.

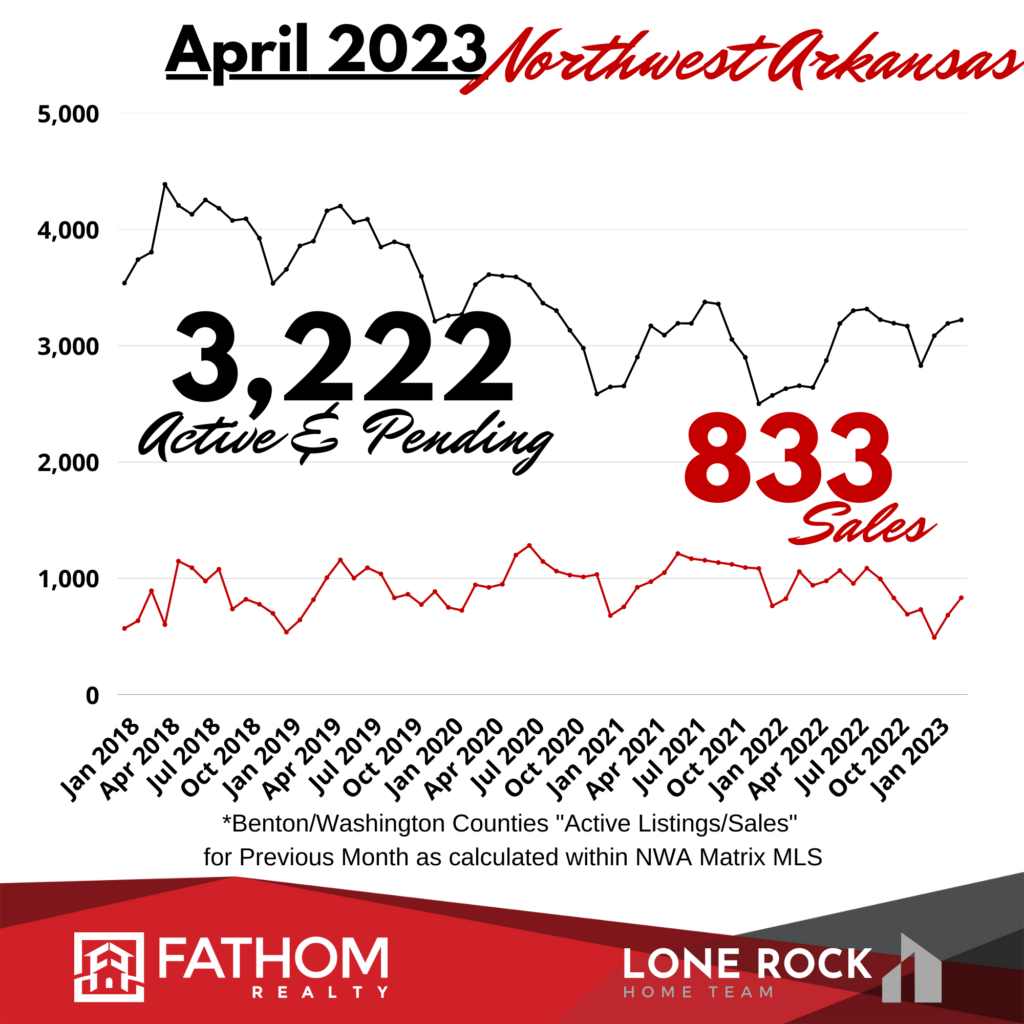

Our Closed transaction numbers will continue to increase as those contracts close out. In the chart below you can see the number of Active and Pending Homes bouncing off the December low and starting to climb with our March numbers finding some resistance as the number of Closings rose significantly, taking that inventory out of the market.

This indicates most homes are finding a buyer fairly quickly, keeping Days on Market low.

Falling interest rates are resulting in higher prices, as expected.

In February, the average sale price was $387,692, but rose to $402,658 in March. This is the 3rd highest number on record, only broken by June and July of last year (2022.)

But the record breaking number was the Median price, as it went up to $350,900. This is higher than the peak pricing of last summer, which contained the previous record of $344,722.

As I thought, the market was building a support level early this year and it broke higher as we moved into the Spring. I expect this trend to continue, with prices generally rising throughout the next several months (although slight fluctuations are normal.) This summer, Home Prices will likely go higher than we’ve ever seen across Northwest Arkansas.

Also, mortgage rates are moving down as big money investors and institutions are flocking to the Bond Market. This is pushing the 10 Year Treasury lower, and Mortgage rates are following it down back to a more normal range. If mortgage rates get back below 6%, this will increase affordability for many people and we will see even more buyer jump into a home purchase.

Overall, we are anticipating a strong Spring market with robust sales numbers and rising prices. Our Average Prices Per Square Foot increased again this month.

What it all Means for You

Will the banking crisis cause the Federal Reserve to reverse course on interest rates? The stock and bond markets seem to think a reversal is right around the corner. Only time will tell, but for now, our northwest Arkansas real estate market is holding up very well and we’re gearing up for a big Summer season.

Right now, I’m seeing a big window of opportunity, especially for sellers since prices are on the rise again. If you’ve been thinking about selling, now might be a good time to consider putting real plans in place to cash out on that equity.

To see the strategies we’ve been implementing to sell for the most the market will bear, Watch my “Pre-Listing Price Accelerator” Guide Here and see How To Maximize Your Home Sale. It will walk you through everything I’ve been doing to get amazing results for my home sellers.

Buyers will soon be facing a challenging market again. If mortgage interest rates continue to fall, there will once again be a flood of buyers coming into the market and competing for the few homes that are available. In that scenario, prices will go even higher. So locking in a good price right now may be a smart bet. And if interest rates happen to go lower in the future, a refinance is always a possibility.

Our lender partners can fill you in on all your options, including mortgage programs like that 2-1 Buy Down we talked about last time.

Also, I’ve put together a program to find “Hidden Inventory, Off Market Homes” for my clients without all the hassle and competition from other buyers.

This is our #1 Strategy to get you and your family out of your current home and into your dream home. Let’s see what we can find together!

Just click here to learn all about the “Dream Home Finder” Program!