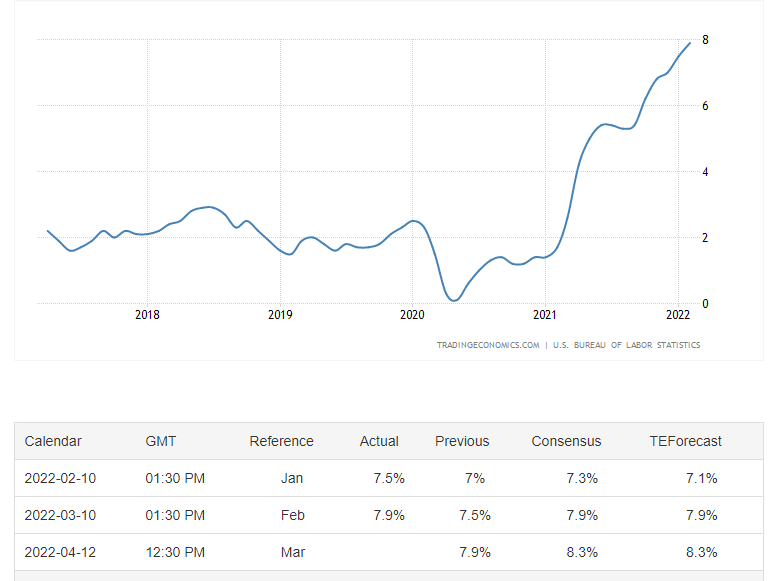

Inflation is hitting the US in a way that many of us have never lived through, and will have effects that no American has ever experienced. The Federal Reserve’s official number for “Annual inflation rate in the US accelerated to 7.9% in February of 2022, the highest since January of 1982.” –tradingeconomics.com

This is direct effect of money printing in the US due to the COVID response, as well as over a decade of low interest rates and Federal Reserve purchases of assets (including Mortgage Backed Securities) since the Global Financial Crisis in 2008. This massive wave of money is now hitting the US economy and resulting in higher and higher prices for almost everything consumers purchase.

Many people are witnessing the rapid pace of home prices rising, and are coming to the conclusion that this will result in a housing market crash in the near future. However, this conclusion is missing the real cause of the price appreciation. The truth is there’s too much money flowing through the system. This increase in the money supply, combined with the very real supply and demand imbalance in housing is what is causing these prices to remain at such elevated levels.

The current economic cycle is looking more and more like a Super-cycle that may be the beginning of an outright currency collapse. The Dollar is weakening against real assets like oil, gold, lumber, and real estate. The Fed’s ability to fight inflation through interest rate rises is severely hampered by the amount of debt the US Government has. If interest rates rose significantly (think 11-20% like in the 1980’s) there is a good chance that not only would the stock market collapse, but the government itself would not be able to pay it’s debts (bonds). Therefore, the only way out for the Fed and the US Treasury is to continue printing, spending, and keeping interest rates historically low.

The massive amounts of currency being created and flooded into the system will keep inflation high. This will make any asset purchased in dollars appear to be very expensive, even though if the price were adjusted for inflation it may be the same or actually even cheaper than before.

The smart bet is to buy and hold hard assets for the foreseeable future, Real Estate being one of those assets.

Northwest Arkansas Housing

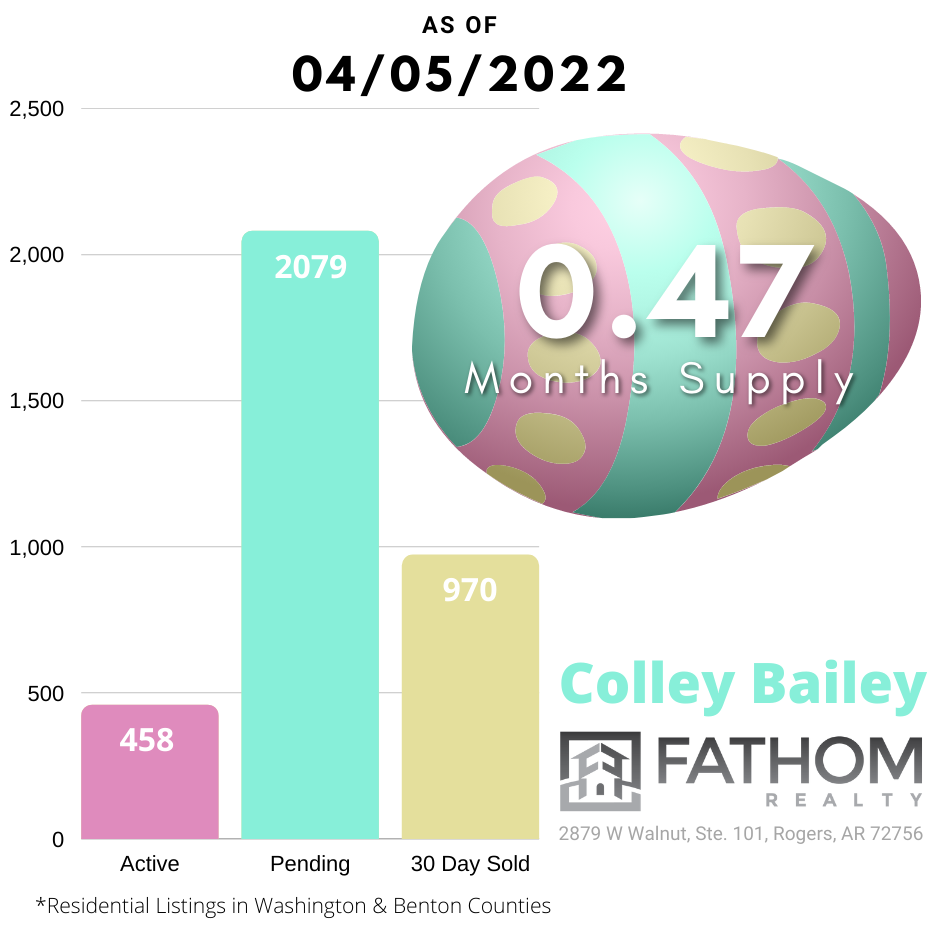

We only had 458 homes in the market on April 5th, 2022. And since we sold 970 in the previous 30 days across Washington and Benton Counties, that leaves us with 0.47 Months of Supply. This is the lowest Months Supply I have a record of.

(That means if we had no more homes enter the market, we’d sell through all the available homes in about 14 days!)

I’d expect this supply number to go even lower coming into our Spring/Summer season this year. We just haven’t been able to get enough homes flowing into our marketplace.

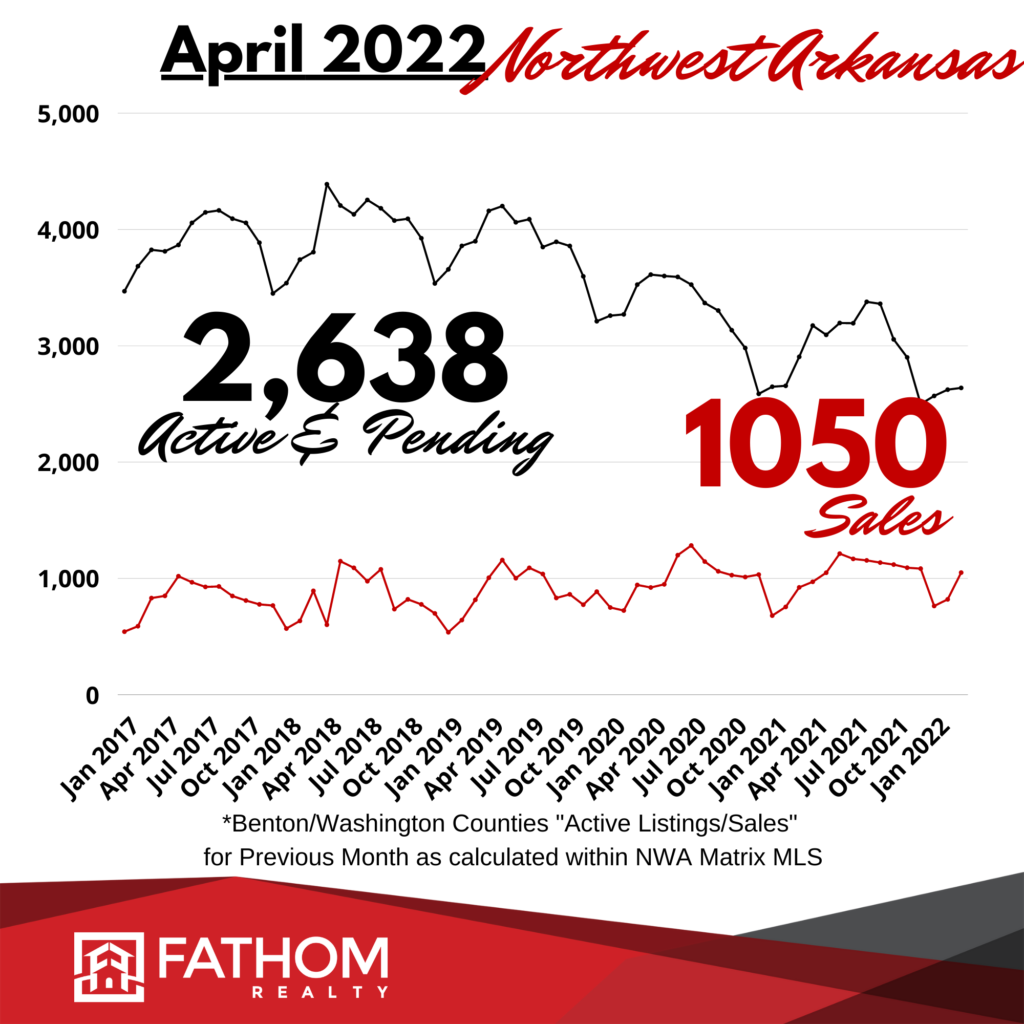

And this continually dwindling supply has brought about record pricing levels. Prices will likely even rise from this level, trending upward through the rest of 2022. There are a few factors that could slow the price growth, like higher interest rates. These higher rates are making mortgage payments significantly higher than they were a few months ago. But all indicators are still pointing toward prices continuing to climb.

Most economists’ forecasts I’m seeing are expecting between 12% and 16% price appreciation over 2022. And with the sales numbers staying this strong, it looks like those predictions could easily come true.

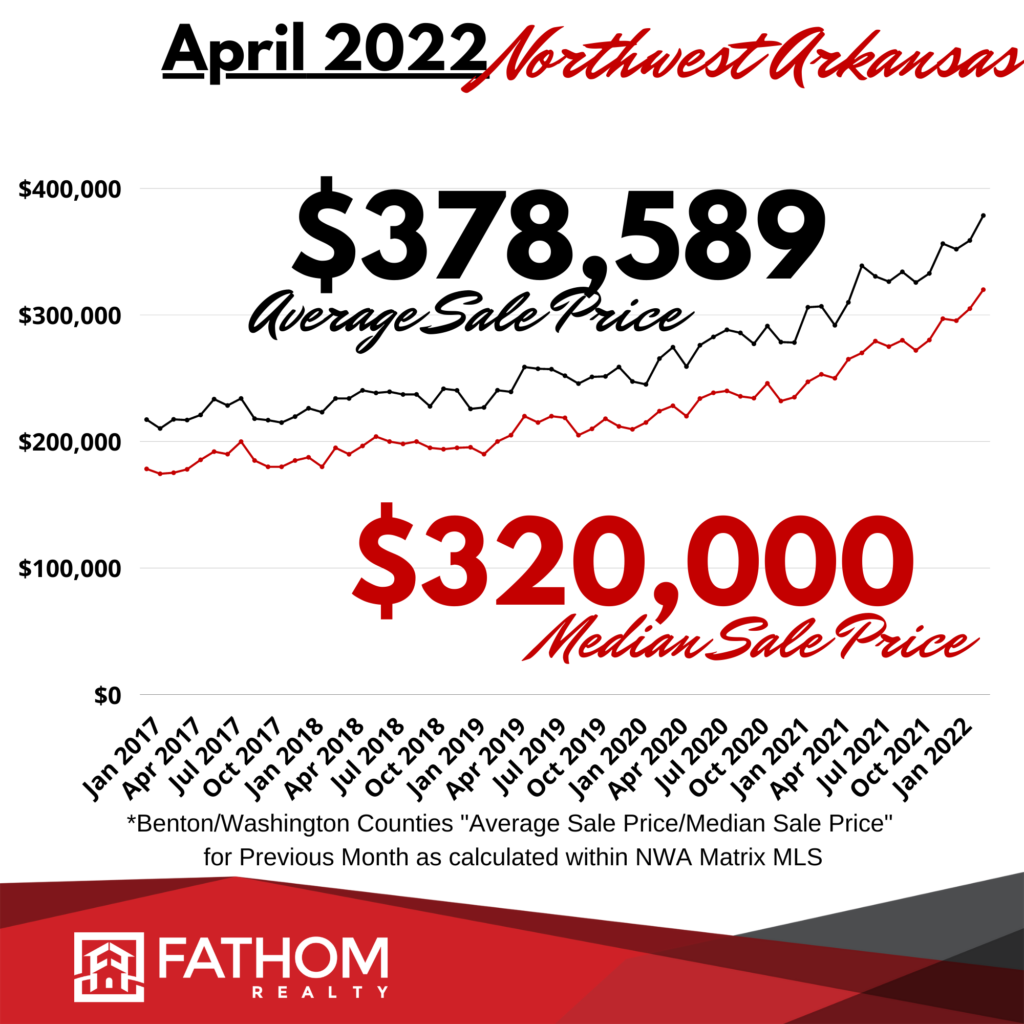

In January, home prices kicked off 2022 at $351,839 (Avg) and $296,085 (Median). Back then, I predicted that if the forecasts hold, we might end up with Averages at or above $400,000 by the end of 2022.

In just a few short months, we’re already almost there. By the end of the First Quarter, our March sale prices came in at $378,589 (Avg) and $320,000 (Median). This represents a 7.6% rise in the Average over just 3 months! Median prices have climbed 8.07% in that time.

What it all Means for You

There is an overwhelming amount of evidence pointing toward prices rising from this level. The longer you wait, the more you will likely pay in the future. And as inflation continues, buying Real Estate makes more and more sense.

If you’ve been thinking of selling your home, right now is a historically good time to do so. These market forces continue to push prices higher and higher across our region.

And even though the prices are already high, my clients have been using my Preparation Plans and Top-Notch Marketing, and have been getting offers at $10,000, $20,000, even $30,000 over the average sales prices for their neighborhoods.

To see the strategies we’ve been implementing, Watch my “Pre-Listing Price Accelerator” Guide Here and see How To Maximize Your Home Sale. It will walk you through everything I’ve been doing to get these amazing results for my home sellers.

But then you run into the problem of finding your next place. Understandably, many potential home sellers have decided to stay put because they don’t think they’ll be able to find their next home with so few on the market. And that’s the big issue, the main problem to solve this year.

For this reason, I’ve put together a program to find “Hidden Inventory, Off Market Homes” for my clients.

This is my #1 Strategy to get you and your family out of your current home and into your dream home. Let’s see what we can find together!

Just click here to learn all about the “Dream Home Finder” Program!